Tracking your investments

In this blog we review investment tracking options and consider investment tracking software for specific types of portfolios. We will tackle the following questions and points:

You can find a short summary provided below:

Why keep track of investments

Keeping track of your investments allows you to have a clear view of your financial situation.

Knowing asset allocations and performances will help you choose, execute, and monitor your investment strategy. It can also help you decide on adjusting your portfolio, i.e., increase your exposure and risk to certain sectors, financial instruments, or alternatively hedge to decrease the risk. We have covered the importance of investment tracking in more detail here.

Investment tracking helps:

- assess investment performance (compare against baseline, other investment types or similar investments)

- anticipate and manage investment risks

- choose, track, and optimize investment strategy

- understand your net worth growth patterns

What investments to track

Financial assets are divided into two main groups:

- Fixed assets (real estate, vehicles, pension, collectibles, etc.)

- Liquid (cash, bank accounts, financial investments like ETFs, mutual funds, stocks, etc.)

Majority of the customers will be more interested in tracking the liquid assets. Tracking information for this group is more urgent and more likely to influence your reactive investment decisions.

Fixed assets are generally held long term and tracking these tends to require less attention, so can be done less frequently. Also, in comparison with liquid assets, assessing accurate values might be trickier and there will be less software options to assist with that.

If you are interested in tracking both fixed and liquid assets for accurate net worth view, you might be interested in our net worth tracking post here.

Investment tracking using Google Sheets

If you have few assets and need just a basic occasional valuation, you might want to have a look at a DYI solution using Google Sheets. It is available for free and investments valuation data is pooled from Google Finance. Find our Google Sheets investment tracking post for further details.

Investment tracking apps

Depending on your investments composition you might have used one or more investment types.

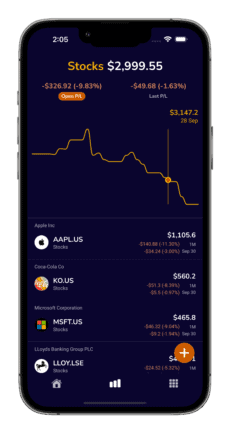

Readily baked apps dedicated for investment tracking will likely be the most convenient and time efficient approach for many users. These applications are purposed to track various investments and have variety of convenient features like investment analysis, screening, news, insights, monitoring, alerting, historical performance graphs, etc.

We have several investment tracker comparisons which includes assessing available applications based on device type availability, residency, country availability, features, pros & cons, etc.

All-in-one investment trackers

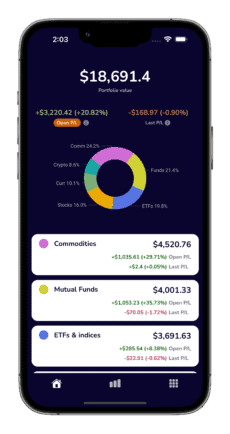

All-in-one investment trackers is a good option if you have a wide range of investments across different financial products like mutual funds, ETFs, stocks, cryptos, precious metals, and others. Hopefully our Totfin app will suite you, but we have also provided a detailed all-in-one investment trackers comparison and analysis here.

Mutual fund investment trackers

Investing into mutual funds is one of the most popular investing options. A common mutual funds tracking problem is finding the tracking application that has data about ALL your mutual funds. Even missing just a single mutual fund data would make the investment portfolio tracker’s mission unfulfilled. Check our mutual funds investment trackers post where we focus on identifying mutual funds, how are they different from other investment funds, how to track them, etc.

Crypto portfolio trackers

If you are looking for cryptocurrency focused investment trackers, we offer crypto portfolio trackers comparison here. Given the unconventional position of cryptos we have considered portfolio tracker features relevant specifically to them (i.e., price sourcing from specific crypto exchanges, whale transactions alerts, direct access to crypto teams’ updates, etc.)

Commodity investment trackers

If you are trading commodities, our review of precious metals portfolio tracking apps might be of an interest to you. For most of customers, commodities investment exists as one of the investment types in their portfolio. If that’s your case, we’d suggest looking at all-in-one investment trackers where you can consolidate commodities investment together with other investment types (i.e., stocks and mutual funds).

Investment trackers for smart watches

If you are Team Smart Watch, looking for investment trackers that are integrated with smart watches might be important for you. We offer insights on investment tracking with Apple Watch here.

SUMMARY

Keeping track of all your investments can be a chore. There are number of software solutions in the market that try their best to make sure it’s not the case.

For most customers, all-in-one portfolio tracker allows them to save time when analyzing whether their investment strategy is working. An all-in-one portfolio tracker should have current and consolidated valuation and historical data in one place, available for at-a-glance overview of gains/losses or further drill downs. We offer an extensive review of available apps, features, and their comparison here.

For crypto investors who focus mainly on cryptocurrency investments, portfolio tracker apps dedicated for cryptos might be the choice. You can find our review and comparison of the best crypto investment portfolio tracker apps here.