Importance of Tracking Investments

Keeping up with the situation of your assets and how they are performing is a responsible financial practice. Investing itself is a deliberate decision that you have got what it takes to succeed, and part of that is tracking your performance. From creating spreadsheets to downloading tracking software or apps, tracking assets in any form or method will always allow for these basic yet essential benefits.

Helps in overall recognition of your financial situation

Knowing your financial situation allows you to work on current and future plans. In my personal experience, asset tracking primarily helps me understand my financial capabilities and decision making. It is important for me to know how much assets I have in a particular or set period of time – for the short or the long-term. It may simply be for the purpose of spending for food, holidays, monthly expenses, or major decisions like getting a mortgage or for growing your investments overtime. Understanding your financial standing at the beginning is a vital step in determining your next financial move.

Allows optimal investment allocation

Correct asset allocation gives your portfolio the potential to optimise its growth. This technique reduces the risk of having sharp financial losses. Some key questions you can ask yourself on this area include: what are the risks for certain segments? How are my assets allocated across segments? What are the best performing segments? How are my assets performing in comparison with market indexes? When you track your assets, you get the clear view of your investments’ short/long term performance as well as risk exposure. This gives you the ability to select right investments and readjust based on shifting market or your personal preferences. Good asset allocation balances investment gains and risks.

Allows asset segment performance comparisons

Asset allocation is a process of continuous fine-tuning. Tracking your assets also helps you identify how your investments are fairing among each other or in the broad market. And over time you get a better understanding of how your investments behave based on their historical performance and valuation. Some investments might have a steep growth over a short period of time, however they might underperform in the long run. So timely tracking gives you an opportunity to rebalance and redistribute your assets to your advantage.

Portfolio Trackers

Global financial integration allows investors to get access to unparalleled number of different assets. If you are using multiple brokers and multiple trading platforms, keeping up to date with all your investments requires increasingly more effort. Here we have a brief look at different investment types and how to keep track of different investments using portfolio tracker applications.

What are the main investment types commonly tracked?

What are some of most common trackable investment types?

1. Stocks (shares of traded companies)

2. Mutual Funds (shares of pooled investors money invested by fund managers)

3. Exchange Traded Funds/ETFs (stock-like investment which is designed to track value of specific securities)

4. Indices (investment which value is tied to group of stocks composing that particular index)

5. Bonds (investment by lending money for agreed interest rate)

6. Commodities (investment in raw materials like metals, grains, coffee, etc.)

7. FX currency pairs (currency exchange rates)

8. Crypto currencies (digital currencies)

Majority of investors will have a combination of these assets in their portfolio. On the other hand more advanced investors can also use derivatives like contracts for differences (CFDs), futures and others. Most likely it will be more than one type of investment to track, so it is crucial that they are summarised presentably in order to understand one’s total asset value and situation.

How can you track investments?

Listing and calculating assets manually is a basic and a classic approach to tracking assets. One common practice is the use of an excel spreadsheet. It is a reliable way of collating all of your investment data. And most people are probably handy with this tool. You can easily input updates in an excel spreadsheet. But such manual approach can be time consuming, and adjusting your excel spreadsheet will be the same chore that will keep you from doing it. What if you just want to spend a lovely weekend chilling? So our vision is to make manual tracking of assets less of a chore.

A number of apps are currently available to support automated tracking of investments. You can find an extensive review and comparison of portfolio tracker applications here. We notice however that each type of asset have their exclusive tracking application. Personally, I keep switching apps whenever I want to see updates on my ETFs, mutual funds and crypto-coins. So tracking multiple assets can still be a fuss when you have to log-in to different applications… you still end up manually summing them.

What should you look for in portfolio tracking applications

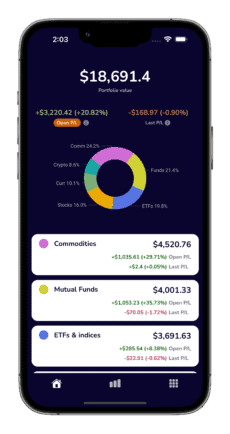

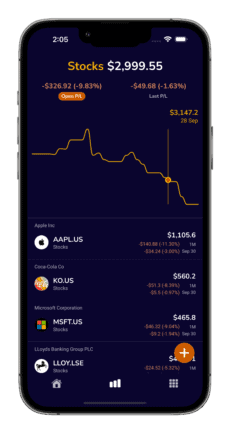

We want an app that makes all trackable assets visible in one place so that there is no need to log-in to three or more apps at a time per asset or to get a total asset value. The TotFin app will track, summarise and give a clear visibility of your assets in total and in each segments. Our ideal portfolio tracker application has:

1. Entire investment portfolio overview

2. Clear asset distribution between segments view

4. Individual asset performance view

3. A presentation of historical growth of assets/portfolio and of specific segments

4. Currency friendly approach to allow selecting or changing main portfolio currency

5. Information on total and day changes of values (all portfolio, segment or individual asset views)

Conclusion

Having a clear view of your finances helps you determine your goals. Whether you aspire to continue investing or simply save for a new mortgage, you should consider asset tracking as a key financial management practice. Ultimately, whatever method you will decide to use to track assets will still be a healthy financial practice!