How to choose best precious metals portfolio tracking app

There are few key questions to consider in choosing the best precious metals portfolio tracking app.

- What precious metals are in your portfolio?

- Do you wish to track spot/future prices of physical metals?

- Are you interested in real-time prices?

- Do you need to track prices of metal backed investments (i.e.: ETFs or mutual funds)?

- What are additional precious metals portfolio tracking app features that are important to you?

We consider these aspects and provide summary here:

Which precious metals are in your portfolio?

Generally, precious metals trading includes gold, silver, platinum, and palladium.

Gold

Not much elaboration needed here. Even though it has some industrial application, it is mainly used for jewellery or as a ‘hard’ currency. Usually, it’s bought as a long-term investment and could help to balance risk of inflation, reduce impact of financial crisis, etc. Physical gold for investments can be bought as bullions bars or coins (British sovereigns, African Krugerrands, etc.).

Silver

Same as gold, silver can be used for investment purposes as well, however it has a wider industrial application (batteries, electrical contacts, medicine, etc.) which also affects its price. Physical silver can be bought as bullion bars or silver coins.

Platinum

Rarer than gold, platinum can be used for exactly the same investment purposes as gold. It does have some industrial application (automotive catalysts) and is used for jewellery. Platinum is mined mainly in South Africa and Russia. Given concentrated supply and industrial application, platinum prices are more volatile in comparison with other precious metals. Platinum can be bought both in form of bars and coins.

Palladium

Like silver, it has industrial usage (electronics, medicine, catalysts, jewellery, etc.). Palladium can also be bought as bars and coins. Worth noting that it is considered a less liquid asset than gold or silver.

Do you wish to track spot prices for physical metals?

Spot price is the current metal’s price in global metals market. Technically it indicates the price which you can buy or sell metals on ‘the spot’ – immediately. Realistically, physical buy/sell of precious metals prices can be also affected by other factors, i.e.: currency fluctuations or brokers premiums.

Futures shows agreed precious metal price in the future. One of the most important precious metals exchanges is COMEX which processes futures trades between buyers and sellers. It’s common that the spot price is derived based on futures contracts of the nearest month, i.e.: Reuters watchlist.

When evaluating physical precious metal price, we can assume that it will have a spot price at premium when buying and a discount price when selling.

Are you interested in real-time prices?

Precious metals spot prices are continuously updated throughout the day and shows price per Troy ounce in certain currencies (usually USD). If you are after real-time prices, Yahoo! Finance App will allow you to add commodities (including precious metals) to your portfolio and track them in near real-time in your selected currency.

Do you need to track prices of precious metal backed investments (i.e.: ETFs or mutual funds)?

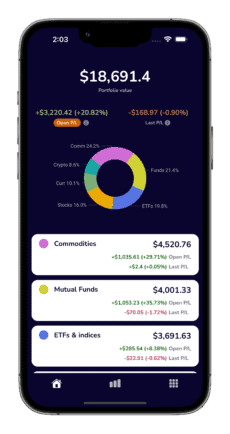

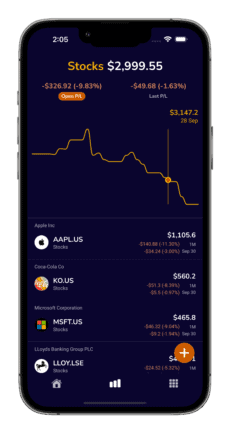

Apart from physically storing precious metals, there are a number of investment products which track precious metals’ spot price. These products include physically backed ETFs or gold mutual funds. If you are looking for an app to track prices of these products, we suggest having a look at our all-in-one portfolio tracker comparison page. You can also select an app that tracks both physical metal prices as well as ETFs or funds in one place (i.e. Totfin).

What are additional precious metals portfolio tracking app features that are important to you?

There are a number of precious metals portfolio tracking features that you might want to consider:

- Automatic currency conversions to your selected currency

- Ability to support other financial assets (i.e.: other commodities, ETFs, mutual funds, etc.)

- Portfolio gains summary and portfolio historical performances, breakdowns

- Portfolio comparisons against baselines (i.e.: S&P 500, NASDAQ)

- Precious metals analysis, news, and insights

We have covered these and other aspects with more details in our all-in-one portfolio tracker features comparison blog. Note that precious metals fall under the commodities category, so you can select portfolio trackers that have “Commodities” in supported assets category in summary table.

Other commodities: copper, aluminum, zinc, lithium

SUMMARY: best precious metals portfolio tracking apps

If your portfolio consists mainly of precious metals, Yahoo Finance app for both iPhone and Android could be a good option. The basic version is free, you can select ounces, currency and it shows almost real-time spot prices. It also has latest related news.

If your portfolio has not only metal commodities but also other asset types (i.e.: ETFs, mutual funds, shares, etc.), TotFin is an option you might be interested as it provides consolidation and extra features out-of-the-box. If you are interested to further drill down to all-in-one portfolio trackers, you can find all-in-one portfolio tracker apps comparison summary table here.