Start Building Your Portfolio: Beginner Investment

How does one start to get into investing? At present time, it is very easy to search online for articles and online educational resources about starting an investment or learning about market fundamentals. Modern technology has paved way for every individual to access trading. A key concept that is almost inseparable from starting an investment is building an investment portfolio, which is particularly regarded by many investors as a fundamental step to investment success. But what is an investment portfolio? And why is it so crucial for starting a successful investment endeavour?

Here are some basic concepts to help you understand investing and how building an investment portfolio can facilitate this.

The Stock Market

The stock market is popularly known to be the place where assets such as stocks, exchange traded funds or ETFS, bonds, mutual funds, commodities, currencies or stocks of cryptocurrency companies are traded. The stock market therefore contains the venues and exchanges where all the existing assets are bought and sold, and other financial activities conducted formally.

In the case of cryptocurrencies, they can be purchased and sold through cryptocurrency trading platforms or exchanges such as Kraken, Gemini, or Coinbase. You can read more about cryptocurrencies here if you want to understand more about how they are created, how they work, crypto terminologies, features and crypto wallets.

Types of Assets

Assets are the investments that an investor seek to purchase or sell. These include stocks, mutual funds, ETFs, bonds, mutual funds, currencies, commodities and cryptocurrencies. These may represent different industries that you align your values with or those that you think might potentially become successful in the short or long-term. For example, banking activities, precious metals, real estate, pharmaceuticals, green technology and so on. When starting an investment, consider allocating your investment budget into a composition of small asset segments to minimize risks brought by market volatility because they perform differently time and event-wise.

When selecting assets, it is important not to jump into the bandwagon. Big companies are usually popular stocks – often in the news and social media – and many might have claimed financial gains from investing in them. But don’t gamble your finances to create a shortcut to success and instead have deliberate knowledge and research about the assets you wish to invest into.

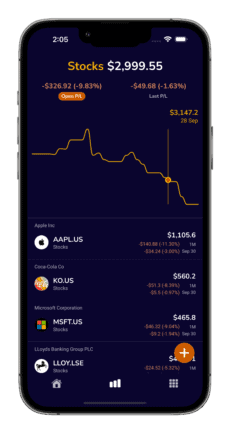

Stocks

Stocks are shares of traded companies. Investing in them takes a more active strategy such as reviewing their past or historical performance, outlook, quarterly reports, and organisational profile or circumstances because they could have a more unpredictable movement within the market. You must be patient and willing to spend time in monitoring them to become effective in building your wealth overtime.

In day trading (“intraday”), an investor uses brokers’ applications to buy/sell stocks within the day or multiple times a day as stocks value rise and dip. This is because the small changes in the rise and fall of asset prices can be profitable if bought and sold at the right time, but this is risky and often compared to gambling. You are more susceptible at buying more volume when a particular stock or market trend turn “bullish” (prices going up), keeping the hope that the asset price wouldn’t take a massive plunge by the end of the day.

There are also derivative financial instruments available for individual investors that have even higher intraday returns or losses on the same backing stocks. Most common examples would include futures and CFDs.

If you are a beginning investor, intraday trading is a risky start. Generally, you would pick up some well-established stocks as longer-term investment (more than a year) within the sector or region that you believe in.

There are a lot of things to consider if you want to go into day trading such as being able to analyse and monitor the market throughout the day, which can be difficult if you have a full-time job or studies and being ready to risk losing your hard-earned money and having positive strategies to cope with loses.

Index and Mutual Funds

Indices are investment which value is tied to group of stocks composing that index whereas mutual funds are shares of pooled investors’ money invested by fund managers. These can be passively managed funds as they could potentially grow steadily overtime, depending on how their backing financial sector performs. It is less risky than what most people fear with stocks because it is diversified – which means that the crash of a single stock that comprise the fund won’t make such a huge impact.

Selecting mutual or index funds (also known as “screening”) can be a laborious process. Usually, brokers have tools that allow you to compare fundamental data and historical performances to make it easier.

Funds are considered less risky than stocks, but keep in mind that all investments pose some risk that you must always be prepared to deal with.

We have written a more elaborate description of the most popular investment types such as mutual funds, ETFs, Commodities, Forex and others in this blog.

Cryptocurrencies

Cryptocurrencies are digital currencies that are available only electronically and does not have a physical form. Investing in cryptocurrencies is relatively new. We have written in our blog a detailed discussion of what cryptocurrencies are and how cryptocurrencies work including mining, wallets, exchanges and trading. Before investing into cryptocurrencies, determine your financial goals and risk tolerance as cryptocurrency prices are notoriously flaky. The most common advantage crypto investors claim is the transaction anonymity and low transaction costs. However, it also poses high risk as absolute majority of cryptos are not actually backed by any tangible assets as well as that governments fight against deregulated nature of such investments.

Investment Portfolio

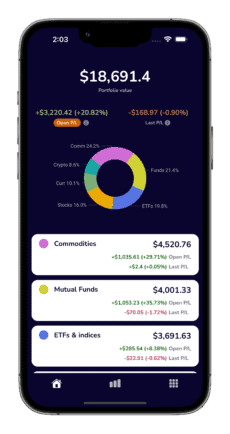

An investment portfolio is a compilation of various assets that an investor owns. The composition of an investment portfolio comprises the different types of assets, and to reiterate, these are stocks, mutual funds, ETFs, bonds, mutual funds, currencies, commodities and cryptocurrencies.

It is important to make sure that your investment portfolio is diversified as this can provide greater returns in the long term. You can do this by allocating your investment budget into fractions of different assets. This way, your investment portfolio can balance loses and gains because a diversified portfolio contains assets that respond differently to similar economic events.

Currently, you must use multiple app sources for trading multiple types of assets and in the case of cryptocurrencies, store them in various wallets. So, having a diversified portfolio does not mean that you just have one physical or digital investment portfolio. You will have to access different programs or applications in order to make sure that you are on top managing and monitoring them. However, this should not take your time, energy and effort. In the next section we will discuss how you can track your investment portfolio.

Buying Assets

Modern trading using technology has opened floodgates for every individual to invest money. The practice of purchasing and selling assets has changed dramatically from finding and liaising with a broker who places your instruction in stock exchange offices to just your fingertips. In the last few decades, access to trading is dominated by wealthy people. Nowadays, everybody can trade, buy or sell assets through the internet and mobile trading applications. Take not that while it is convenient, easy and quick to invest through digital platforms, it is also to easy and quick to commit mistakes and fall trap into investment scams being thrown into your screen. Even if you think you might be adept in navigating trading platforms, you should first rationalize, study and create a sound investment strategy.

When buying assets, make sure that you have the knowledge which trading platforms work for you and your investment goals. If you are not able to do this by yourself, or are not sure about your options, it is always possible to seek financial advice to have clearer understanding of the trading process.

Fundamental elements to consider before buying an investment

Investing in stocks, mutual funds, ETFs, indices, or cryptocurrencies might be an interesting yet a scary idea to venture into. People hear mixed stories about how investing make people acquire or lose their fortunes, that it’s a roulette of success and loss, or something like gambling.

One fundamental consideration to starting investments is the resolve to be diligent and self-disciplined about accomplishing the goal and objectives that drives your desire to invest. Investing have different outcomes for everyone wherein risks and potential gains are usual elements often confronted by investors. So, it is important to have the patience and firm consideration especially of potential risks when you start investing.

When done smartly, investments are one of the best avenues to grow your wealth.

How much of your money should you invest?

Before you start thinking of investing, have a review of your finances, budget and spending. Being able to optimise your finances and becoming efficient in managing them is the always the first step. Do not disregard your bills and essential expenditures in order to divert them into investments with an expectation that it will quickly provide withdrawable revenue to relieve your expenses.

A common approach when starting an investment is putting 10% of your annual income into investments. This can be a good rate to begin investing, and from there, you can decide to increase it according to your goal. Look at our tips on how to ensure allocating money appropriately for investments. Most people invest for the long-term, such as for retirement or paying-off mortgages.

Keep in mind that it is safer to have three to six months’ worth of savings before you start investing. Make sure that your debt is manageable and that you have emergency funds available too.

What about opening an investment account?

Investment accounts generally allow your savings to produce more interest or returns in comparison to keeping them in a bank account. This is because your money is deposited into a brokerage account that allows you to buy assets that can increase in value, such as stocks or mutual funds, and therefore allows your savings to grow in the long-term.

There is a wide variety of investment brokers (banks, companies, etc.) that you could open an account with. Generally, this can be done by simply downloading a mobile app and going through a registration process that will require your personal details and initial funds deposit. Depending on your residency and investment type preference, you can pick up the brokers that suit you the best. Note details on management, buying and selling fees as these might add up quite quickly. It’s common to have multiple brokers for different investment types.

There is always an option to also consult a financial advisor to help you decide which investments would help you to attain your financial goals.

Role of digital trading platforms

Digital trading platforms are the tools that enable you to start investing by just using your phone or computer, anywhere and in your own time. They help you manage your investments from buying, growing and selling them. Now that there are abundant applications that are affordable and easy to navigate without the help of personal brokers, you can have full control of selecting and managing your assets. They can provide information on market performance and trend to help you decide which assets to buy. Factors that can help you select trading platforms include features such as available range of assets that you can buy such as stocks, indices, mutual funds or bonds, user interface that is easy to understand and navigate, and the fees they charge. And while digital trading platforms enable you to manage your portfolio independently, just remember that this means the responsibility and accountability of your choices also rests solely on you too.

Tracking your Investment Portfolio

When you finally have your investment portfolio completed, monitoring and evaluating their performance is crucial. Keeping track of your investments allows you to view your investment situation and performance. Key questions include:

- Which assets are performing best?

- Which assets are performing poorly?

- What and when could you potentially purchase?

- What and when could you potentially sell?

In our blog we talked about tracking your investment as crucial in anticipating and managing investment risks and optimizing investment strategies and growth.

We discussed earlier that you may not have all your investment recorded in one single digital program or application. For example, Stocks and ETFs could be in HL and cryptocurrency investments might be in cryptocurrency wallets. In this case, tracking your investments might be quite a chore to do if you’ll have to spend time opening every application in checking them.

If you are looking for consolidated tracking for all types of your assets, we have written an extensive review of available portfolio tracker apps, features, and their comparison here.

Summary

Building an investment portfolio might be easily accessible nowadays, and many articles, blogs and educational tools are available online help every individual embark on investing. But remember that investing is not a get rich quick approach and it would require a lot of time, effort and patience in order to create, manage and monitor investment techniques that are strategically, financially and personally sound.