A Reflection on Personal Budgeting

Budgeting apps are powerful tools promising to help you manage and save money or even change your financial practices for good. However, some of the most basic personal budgeting practices that we tend to forego will still render even the best budgeting apps unusable. Taking responsibility doesn’t mean you have to purchase the best app, although it would help, but it is basically becoming self-aware of your financial gaining and spending capabilities.

Let’s forget about the budgeting apps out there for a while (honestly, you’ll have to set aside budget to pay for them monthly but will be surely useful if you stick to them). What can we actually do realistically on our own to avoid financial disasters? Here are some of the most basic budgeting practices that can help us go back to our senses even without the help of budgeting apps.

Listing down all your income streams

Identifying your main financial sources should allow you to think about contingency plans when one of them stops providing you the income which majorly sustains you. Your streams of income might be active or passive. And it would be awesome to have at least both if not multiples of them. Some of the most common income streams can come from the following sources:

- Earned income – your main income, i.e., your permanent job

- Profit income – products or services that you sell

- Interest income – from saving investments schemes

- Dividend income – from stock shares that you buy

- Rental income – generated from rent

Some very popular go-to passive source of income from blogging, vlogging, and posting videos on YouTube. They all don’t provide a steady or stable income source but they’re still very important income streams that you can tap to relieve some expenses. At some point in your life earned income should preferably be not solely relied upon. If in case, your main job stops providing you your main income, be sure to have enough budget to sustain you for at least three months before you find a new job.

Listing down and prioritizing all of your non-negotiable bills

Listing down and immediately setting aside money for your rent, utility bills, or mortgages should be a no brainer, and yet we still get into a crunch when the bills come. It is difficult to accept that all you worked for the month just evaporates when it’s time to pay your lion’s share of bills, or in times of unavoidable circumstances. But it will be a relief to remember that prioritizing to pay these important bills are what will get you through avoiding unnecessary debt in case things go south. Surely, we all want to avoid sleeping on a friend’s couch. When payday comes, we’re all excited to buy the new shiny piece of junk or try the new overly expensive restaurant. We would if we could! But hit the brakes and think twice before succumbing into unnecessary spending. Here is the list of the most common non-negotiable bills:

- Housing

- Utilities

- Food

- Transportation

- Debt (student loans, credit card payments)

- Child-care (if you have children)

- Medical expenses

Always setting aside money for your most important expenses is always the way to go, because who else can pay willingly for your essential bills other than you? Once you get your income, think about your mortgage, utility bills, and food first and foremost and you’ll be relieved to know that you can do anything you want with the remainder of your money once you have settled your priority expenses.

Avoiding petty debts

Credit cards may have their potential benefits like building up your credit rating and for purposes like having purchase insurance, but it shouldn’t be your default spending instrument. Try to avoid using your credit card for small purchases as much as you can. Learning from mistake, this is just a no go as it felt like paying twice for delaying what is inevitable anyway. Paying for restaurant meals, small subscriptions, or clothing shouldn’t have to go through your credit card. Forget about the points, just remember that debts can easily balloon and go out of hand when you get encouraged to spend frequently on “small” stuff. Keep your credit card for emergency purposes and pay with either cash or debit as a practice. This would also keep your spending in check and inform you of your actual remaining allowance until you get to your next paycheck.

Paying your debt

If you’re already in debt, don’t opt for paying minimum as it would cost you a lot of interest. Get a chunk from your income to cover these debts as soon as you’re capable. We may never run out of debt (like mortgage) but at least you won’t have all the petty debts surrounding you like flies buzzing around your head.

Getting a chunk of your monthly salary into an untouchable savings pot

This is very hard to sustain but it would feel great to see once you’re making progress filling this pot into a significant amount. When you see this pot getting filled up with savings, it will be just hard to touch and take away the progress you are making. Even if you don’t have any plans or goal where to spend this money for, you will definitely thank yourself and find peace in knowing that there is a contingency budget ready to save you in time of any disaster. It would be best to have a savings account apart from your spending account. I.e., Monzo is a digital bank app that allows digital pots to be created separate from your current account. It is easy to transfer to these pots and keep these pots secure in a manner you prefer.

Purchasing smarter

We know that quality comes with a price, but most of the time you can find similar quality items that are cheaper. At some point in our lives we are put in restrictive financial situations wherein we can only purchase what is necessary rather than what seems to be just fancy. It would be great of course to get both, but it is not always the case for many. Educate yourself and don’t fall into marketing traps and try to analyse if people are trying to sell you same quality items or services with massive payment difference. Don’t just shoot things into the basket without doing proper research on your purchases.

Getting a sideline job

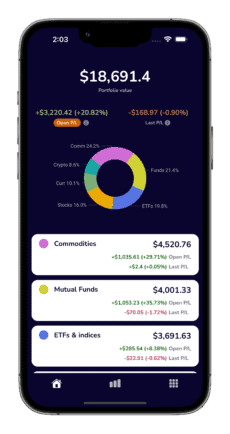

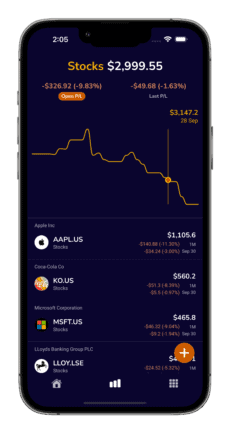

When done right, it’s a great passive income source. If you would like to invest into the hottest venture of the moment which is the cryptocurrencies, be sure to do your research well. To decrease risks of loses, find a stable investment fund, shares or indices to balance it up instead of going full-on gamble with your money towards a potential investment hype crash.

Investing

Getting a sideline job is definitely one of the most reliable sources of extra income. It greatly relieves you some of either shortfalls from your main income or even if you just want an extra budget to splurge onto an interest. It could be something you could do and get paid per hour, bonus points if it’s something of your interest too, like baking or teaching sports. Investing in stocks or shares is another way to have income as long as you do due diligence in tracking and selecting which stocks or shares to buy. You can check our blog entry regarding investments tracking here.

Being honest

If you’re broke, be honest. Firstly, to yourself and to others who has different expectations from you. It would save you a great deal of inconvenience of trying to prove otherwise. At the same time, you won’t go and fall deeper when in a state of financial crisis. If you can’t afford a holiday at the moment, be honest to your friends or family and if they’re genuine with you, they would understand your situation and won’t judge you.

Never depriving yourself

Even if you’re in the average earning category, never deprive. This is tricky and in certain cases it might sound contradictory with the untouchable saving pot guideline. But consider where you want your savings to go to. Does it include holidays or treating yourself once in a while? Is it for a mortgage down payment? Surely, you would like to treat yourself once in a while within the bounds of your financial situation. You don’t have to wait until you’re 70 to go on a first holiday cruise because you’re always afraid not to have enough money for emergency. Balance is the key and while you know that saving is of utmost importance, so is your well-being!