What is a stagflation?

Stagflation means economic stagnation while having high inflation at the same time. Stagnation manifests itself with rising unemployment and stale or declining business performances. The combination is now affecting several major economies during this post-covid pandemic time.

Why do we have a stagflation?

The Covid-19 pandemic heavily impacted all major economies through number of lockdowns, closed businesses, risen unemployment rate, disrupted supply chains, etc.

Governments reacted by helping businesses to stay afloat with recovery packages and grants. This was financed with freshly ‘printed’ money created by quantitave easing, or QE. Large injections of cheap accessible money into economy drove the value of the money down.

Together with new money released into economies, interest rates were cut down (i.e.: in US) to make them more affordable to borrow.

Another factor driving higher consumer prices (inflation), was increased post-pandemic demand for goods and services (i.e.: travel and hospitality sectors), forming spikes of demand waiting for businesses to adjust supply.

Europe also has a gas crisis which is pushing energy prices up. This is basically rippling across all services and products and therefore pushing final consumer prices up.

These, and other reasons, are lethal combinations causing inflation to rise.

In the meantime, we have businesses still recovering and adjusting to the post-pandemic world, which means economies are stagnating, and unemployment is high.

As a result, we have stagflation: inflated consumer prices in stagnating economies.

What does stagflation mean to my investments?

There are two aspects to consider: what are the new investing opportunities and how will my current investments be affected?

Giving suggestions on investments is out of scope for this blog. We can only briefly mention that as of the fourth quarter of 2021, analysts are suggesting to look at commodities which will inevitably have more demand as the world transits into ‘greenifying’ economies. If you wish to find more about commodities, have a look at our commodities notes. Europe stocks are also considered undervalued as of the fourth quarter of 2021. Another generic analysts’ advice to counter stagflation is having a safety net from value investing.

Note that different economies have different stagflation response measures which can affect currency ratios (i.e., GBP to USD). Currency differences is something to keep in mind if you are interested searching for new global opportunities.

For current investments, numerous companies or sectors are enjoying post-pandemic growth. We have seen massive returns in S&P 500 and sectors like energy, technology, finance, etc.

Chances are that the value of your investments rose as well. One way of looking would be that pandemic-resistant investments helped to protect against inflation. The true value for such investments increased or stayed the same while market adjusted prices for inflation.

What does stagflation mean to my portfolio tracking?

If you have a global portfolio, one thing to pay closer attention is currency changes. Currency exchange rates might drive foreign investments up or down even if the actual capitalization of the investments stays the same.

Ideally, you’d have a portfolio tracker that is currency friendly. It should correctly calculate gains or losses by applying not only the latest rate, but also by using actual historical rates when calculating historical performance.

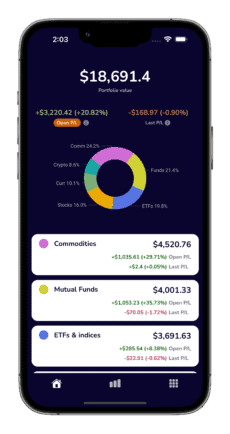

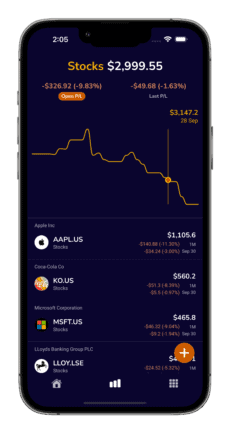

If your portfolio has multiple investment segments (i.e., commodities, ETFs, stocks, funds, cryptos) that have been bought to balance your portfolio against inflation, having all-in-one portfolio would be convenient.

Exactly for that purpose we have created TotFin portfolio tracker. Take a look if that’s something you wish to have as a portfolio tracking tool.

How long will stagnation last?

It is hard for central banks to tackle both inflation and stagnation at the same time. Addressing stagnation requires competing measures to address inflation. This includes increasing interest rates to reduce inflation and keeping interest rates low or pushing them down to reduce unemployment.

There is a new buzz term called ‘transitory inflation’, but it is not clear what exactly ‘transitory’ mean and how long will it last. Inflation tends to be sticky and even though it was expected to go away until end of 2021, it is still currently going strong.

Historically, the US had another instance of stagflation in 1970s which took few years to recover from.

Summary

Stagflation is economic stagnation and inflation combined. It is unpredictable how long the current stagflation will last. You might consider shielding your cash and portfolio with value-based investments (value stocks, funds, ETFs) or commodities. To consolidate portfolio performance tracking for any combination of these asset types, we offer TotFin portfolio tracker.