How to choose the best all-in-one portfolio tracker that fits you

If you are reading this post, chances are that you are looking for a solution to track all of your investments in one place. What exactly fits YOU depends on your needs and preferences. Your time is a commodity (pun intended), so we will highlight portfolio selection aspects covered in this topic straight away. See further details below and decide if they’re relevant for you. To find the best all-in-one portfolio tracker we will need to answer these questions:

- Do you need all-in-one portfolio tracker application? Would Google Sheets suffice?

- What are the investment types in your portfolio (i.e., mutual funds, stocks, ETFs, cryptocurrencies, commodities)?

- Which portfolio tracker applications can track ALL of your individual investments (i.e., which exchanges, regions, fund managers, digital currencies are supported)?

- What is your preferred device type (i.e., iPhone or Android mobile phone, Mac or Windows laptop, smart watch)?

- Do you need automatic transaction synchronisation?

- Are you looking for a free only solution?

- What are the all-in-one portfolio tracker features that are essential to you (i.e. at a glance summary, benchmark comparison, growth projections)?

Answers to above questions will help you to select the right all-in-one portfolio tracker. We will go through these in more details and will provide a comparison table with summary analysis for what we think are the best all-in-one portfolio tracking options in the market.

We will also elaborate on our selection and will mention several products that did not make the cut and the reasons behind it.

Do you need a portfolio tracker application? Would Google Sheets suffice?

Google Sheets is a free web-based spreadsheet provided by Google Drive. Your standard MS Excel files uploaded to Google Drive can be edited using online Google Sheets editor. It provides access to Google Finance data via GOOGLEFINANCE function. To get information about various securities you could use the cell function formula to load financial data, i.e.:

Google Finance provides data on various currency pair exchange rates, stocks, ETFs and mutual funds across number of exchanges supported by Google.

Note that this data is shown only using Google Sheets online. The GOOGLEFINANCE function is not supported in Excel directly. So, when you sync your Excel file edited on GoogleSheets from Google Drive, your local Excel file will show “#NAME” value (indicating an unknown GOOGLEFINANCE function for Microsoft).

To parse financial data in Excel directly, you could use Microsoft Excel’s Stock Data Type integration. Alternatively, you would need to export actual Google Sheets’ online values to Excel.

At the moment, to load market values for cryptocurrencies and commodities with Google Sheets you would need manual workarounds that involve attaching third party (i.e., Yahoo Finance) data using Google App Script. Any other features you’d like to apply to your investment portfolio (i.e., historic performance graphs, summary by investment types, recent value changes, drill downs, comparisons, currency conversions, etc.) would need to be created manually.

PROS:

- Free access to large set of stocks, mutual funds and ETFs powered by Google Finance

- Near real-time data updates

- Offline access allowed within Google Sheets mobile app

CONS

- Adding cryptos and commodities requires scripting

- Actual pricing data is available online, but it cannot auto sync with Excel for offline usage

- Other portfolio tracking features need to be created in spreadsheet by hand

So, spreadsheets COULD be used to track your investments, however personally I think it’s more of a DYI solution that will require a lot of time maintaining it. If you wish to give it a go, find our Google Sheets Portfolio Tracker blog here.

What are the investment types in your portfolio?

Here we are looking at the best all-in-one portfolio trackers. We will compare products that support at least two of asset types listed below.

Mutual funds

If you have mutual funds in your portfolio, then you must have an investment broker which you have used to purchase it (i.e., InteractiveBrokers, Hargreaves Lansdown, etc.). However, to check your mutual funds investment value (NAV), you’ll likely you need to log into one or more broker specific applications each time. Tracking all your mutual funds with single all-in-one portfolio tracker application would save the hassle of simple valuation update checks and could also allow additional features that are not included in your broker apps (i.e., analysis, screening, benchmark comparison). Note that mutual fund valuations are updated at the end of day (EOD), so real time data won’t be available in some tracker applications.

More detailed look at mutual fund dedicated tracking can be found here.

Stocks

Pretty much any self-respecting investment tracker will provide pricing updates on stocks. It’s important to confirm which stock exchanges tracker apps pool the data from. There shouldn’t be issues getting quotes for companies from major stock exchanges (i.e., NASDAQ , LSE, etc.) however some portfolio trackers might have missing stocks from relatively less known exchanges (i.e. Santiago Stock Exchange). It might be worth confirming that your chosen asset tracker supports all your stocks.

ETFs

From a portfolio tracking perspective, ETFs (exchange-traded funds) are very similar to stocks. ETFs are issued by managing companies (i.e., iShares, Vanguard, etc.) but unlike managed mutual funds, exchange-traded funds directly follow the prices of backing assets (i.e., FTSE, physical gold, etc.). Compared with mutual funds, that makes it easier to price ETFs. So, values are continuously updated throughout the day like stocks. And like stocks, ETFs are traded in stock exchanges by brokers and transaction fees and commissions apply.

Cryptocurrencies

From a value tracking perspective, cryptos (digital currencies) are similar to traditional currencies (fiat currencies). Exchange rates for digital-digital and digital-fiat currency pairs are continuously updated across cryptocurrency exchanges (i.e., Coinbase, Binance, etc.). And like how fiat currencies are stored in bank account(s), cryptocurrencies are stored in crypto wallets (i.e., Coinbase Wallet, Atomic Wallet, etc.) or crypto exchange accounts.

When you buy multiple cryptos with a view of investing, you have to log into one or more crypto wallets to check latest exchange rates (price valuation). The job of a decent portfolio tracker will be to reduce the need to log into every crypto wallet and provide a summary in one place. Extra features provided by all-in-one portfolio tracker (i.e., related news or price change alerts) might be also beneficial.

You can find details on key concepts like crypto mining, Blockchain, wallets, exchanges, trading, staking and others in our cryptocurrency demystification blog here.

Commodities

The commodity investment sector utilises trading materials like oil products, metals, agricultural goods and others across commodity exchanges (i.e. Chicago Mercantile Exchange, London Metal Exchange, etc.). Some common use case for individual investors are long-term investments to physical precious metals like silver or gold bullions, coins, or bars. If you are one of these investors, you could track value of, for example, gold sovereigns or krugerrands, by using price-per-ounce gold value in the commodity market.

Forex

If you have a multi-currency portfolio, a tracker application must support Forex exchange rates. You might have either cash or investments that are in different currencies that need to be reflected on your main portfolio currency. One thing to watch out is the historical gain/loss calculations feature. Some portfolio trackers apply current exchange rate for all past evaluations – if you’ve bought assets in currencies that were fairly fluid in the past, that might distort portfolio performance graphs substantially.

Others

Which portfolio tracker applications can track ALL of your individual investments?

If you have a fairly diverse portfolio, this might be THE question. We analysed 30+ portfolio trackers and the fact is that if an application CLAIMS to support some investment types, it might not necessarily do it well at all. That is especially true with mutual funds, where applications usually support just a tiny fraction from the ones available in the global market. Another thing is identifying your asset for the tracker – you might have multiple exchanges trading the same asset, different identifiers for the same asset or different assets with nearly identical names. We will try to shed some light on that.

How to find your investment in a portfolio tracker

All decent portfolio trackers will provide search capability for investments, likely a search box with auto-completion. What to type into that however is not always straight forward. If you will search by investment name, you might have:

- too many results – meaning you need to filter further

- similar results – which makes you doubt if that’s actually the same security which you have

- no results – which makes you doubt if the typed-in search name matches what is known to the tracker OR if there are truly no results

For any of these cases, we’d seek to uniquely identify the asset so that there is no room for misinterpretation within the portfolio tracker.

How to identify your stocks, cryptos and commodities for all-in-one portfolio tracker

For fiat currencies it’s clear: it is universally identified by well-known currency code (i.e., GBP, USD, EUR).

For cryptocurrencies: they have a well-known main identifier, but could also have alternative identifiers (i.e., Bitcoin is known by BTC or XBT). In general, it’s fairly consistent across the globe and there shouldn’t be much trouble identifying cryptocurrency for your portfolio tracker.

Stocks and ETFs have unique asset identifiers as well. Portfolio trackers have identifiers composed of:

- a ticker, which is a local identifier/code within particular exchange (i.e., “AAPL” for Apple in Nasdaq or “VOD” for Vodafone in LSE)

- an exchange code, which is the portfolio tracker’s own identifier for specific exchanges (i.e., LSE could be identified by “LON”, “L”, “LSE” or other depending on the tracker)

AAPL.NASDAQ: could be the unique identifier to track Apple stock price from NASDAQ exchange

IITU.LSE: could be the identifier for “iShares S&P 500 Information Technology Sector UCITS ETF USD (Acc)” ETF price to track from London Stock Exchange

Commodities might be wrapped as futures and trackers will likely identify them with the same pattern as stocks/ETFs (i.e., “GC” for gold ticker, “CME” for COMEX exchange).

GC.CME: could be identifier to track gold price from COMEX

How to identify your mutual funds for all-in-one portfolio tracker

Mutual funds are a little bit trickier and we have more detailed mutual fund’s identification explanation here, but generally each fund will have:

- an ISIN number, which uniquely identifies that mutual fund globally

- a short code, which can have different formats (i.e., for US funds tickers, five symbols ending with X like “FCVTX”, “SWSCX” are used)

ISIN: “US8085096738” (ticker: “SWSCX”): identifies “Schwab Small-Cap Equity Fund” mutual fund to track

You can find some tips how to find mutual fund’s ISIN here.

If you are not able to find your mutual fund by ISIN, short code or name match in the tracker… well, maybe it’s not there 🙂

What is your preferred device type?

There are still a few Windows/Mac portfolio tracker applications, but majority of them are either online web or mobile apps. Recently, there is a clear shift towards mobile friendly applications. If you want a mobile-first solution with offline access convenience, push notifications and auto-updates, you can use an iPhone or Android app. On the other hand, web based online solutions are available on both desktop and mobile browsers. Recently there is a rise of smart watch apps, so some features are available in iOS/WearOS watches as well. We categorised all-in-one portfolio trackers in a comparison summary table as:

- iPhone or Android app

- Web application (online)

- Mac or Windows software

- Apple or WearOS watch

Note: if you are Apple Watch user, you might be interested in our blog on Apple Watch portfolio trackers as well.

Do you need automatic transaction synchronisation?

If you frequently buy or sell assets and you don’t have automatic transaction synchronisation, manual input in the tracker might be laborious.

To keep your asset quantities up to date you have four options:

- update tracker’s transaction details manually

- allow tracker to load transactions from your brokers directly

- allow your broker to notify your portfolio tracker (very limited number of brokers support such integrations)

- combination of above

Updating portfolio transactions manually is the safest option, however if you are buying/selling say stocks and cryptos on a daily basis, it might be off putting manual work overhead.

On the other hand, there are portfolio trackers that can automatically load transaction data from your brokers. Authorising access (especially for ALL of your assets for that single application) is a privacy exposure and increases risk of security breach. Such portfolio trackers need to prove they have genuine bank-grade security level.

Will you wish to provide personal details and allow all-in-one portfolio tracker to query your transactions from your investment brokers? We consider this aspect as one of the key criteria for selecting the best portfolio trackers and we highlight broker linkage feature in the comparison summary table.

Are you looking for free only solutions?

Software companies will need to monetise their products one way or another. Paid products are not necessarily better but worth keeping in mind that even free products will charge you indirectly (your data, ads, related services, etc.).

In our all-on-one portfolio trackers comparison table you will see whether apps are free, freemium or paid.

We have excluded few cheeky applications that require payment details before any demo or elaboration of features list.

What are the common portfolio tracker features?

What is the main intent of having a portfolio tracker?

Here we focus on all-in-one portfolio trackers, rather than budgeting or investment management tools, even though there are some overlapping features.

Are there specific essential-to-have features that you require? We grouped portfolio tracking features into:

- asset support: which investment types are supported and how good is investment selection for each

- broker linkage: broker account linking support (transaction synchronisation), wallet/exchange linking for cryptos

- portfolio summary: at a glance aggregation view, allocation distribution by segments, net worth view, etc.

- drill-down: detailed asset-specific information

- portfolio gains: daily and total gains for portfolio, segments and investments

- historical performance: portfolio’s past performance charts, wealth growth charts

- monitoring: price change alerts, upcoming events alerts (i.e., dividends, earnings report, etc.)

- comparison: performance comparisons against various benchmarks

- news: asset related news and commentary

- analysis: risk estimations, x-ray views, future projections

- research: investment screening, robo-advisors

- global: multi-currency support, global multi-region data, etc.

- update frequency: how often asset valuations are updated

Soo... which all-in-one portfolio tracker FITS you?

Comparison summary table: best all-in-one portfolio trackers 2021

| Name | Assets | Devices | Price | Global | Features | Delay | Notes |

|---|---|---|---|---|---|---|---|

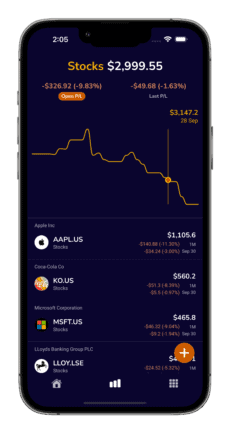

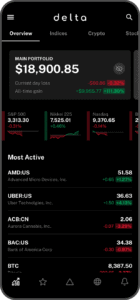

| Delta app | Stocks ETFs Crypto | iPhone Android | Freemium $65 p/y | Global | Crypto linkage Summary, gains Drill down News | 15min+ | Crypto-focused app with crypto exchange and wallet linkage capabilities. Can also track some stocks and ETFs from major exchanges. |

| Personal Capital | Stocks ETFs Mutual Funds | Web iPhone Android Apple watch | Free | US | Summary, gains Broker linkage Drill down Comparison Analysis Historical charts | 4h+ | Investment orientated tool for US with focus on its paid advisory services. Links up your broker accounts and has a nice analysis and performance features for your portfolio assessment. |

| Sharesight | Stocks ETFs | Web iPhone Android | Freemium £216 p/y | Australia Canada New Zealand UK | Summary, gains Drill down Comparison Historical charts | Daily | Online application with limited companion app. Focused on stock/ETFs but also tracks very limited number of mutual funds and crypto investments. Few interesting features on dividends and tax returns. |

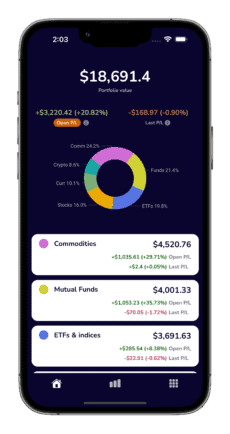

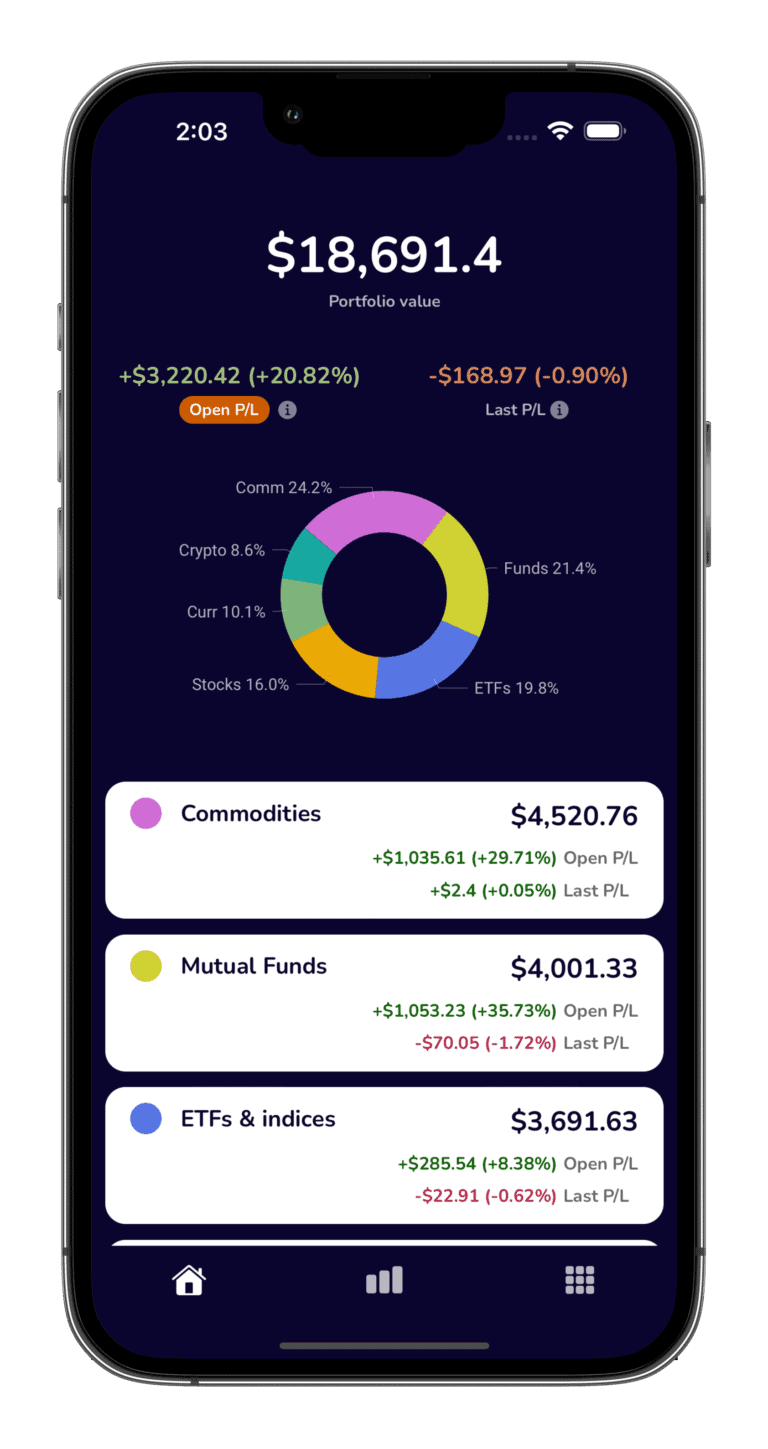

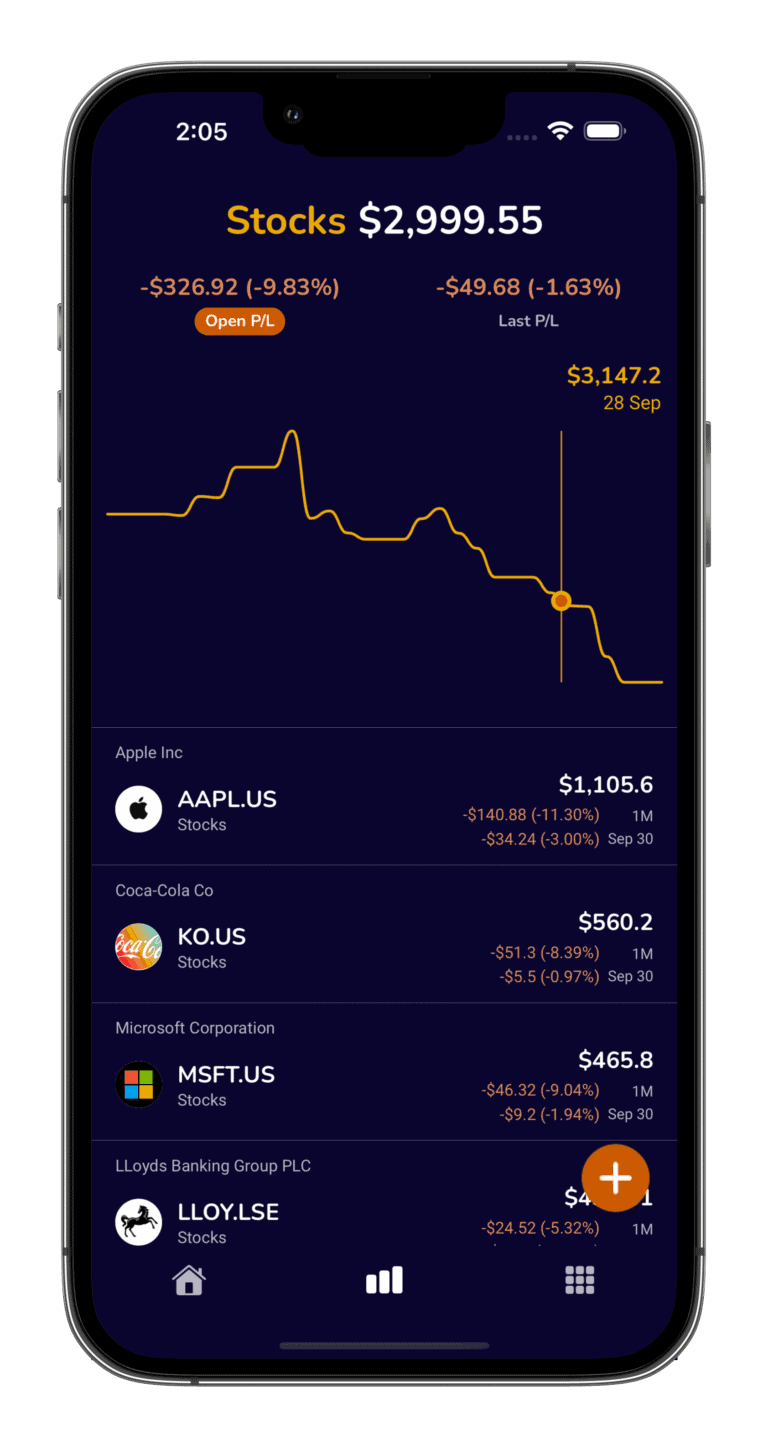

| TotFin app | Mutual Funds Stocks ETFs Commodities Cryptos | iPhone | Freemium | Global | Summary, gains Drill down Comparison Historical charts | Daily | Mobile native iPhone app dedicated for investment tracking not only in North America but globally as well. Supports all investment types with vast pool of data. Modern, simple and clean user interface. |

| Wealthica | Stocks ETFs Mutual Funds Crypto | Web iPhone Android | Freemium $250 p/y | Canada | Summary, gains Broker linkage Drill down Comparison Analysis Historical charts | Daily | Investment orientated portfolio tracker tool for Canadians with broker integrations and auto-syncing at heart. Has manual portfolio export from Yahoo! Finance feature for real-time tracking. |

| Yahoo Finance | Mutual Funds Stocks ETFs Commodities Cryptos | Web iPhone Android | Freemium $350 p/y | Global | Summary, gains Broker linkage Drill-down News Monitoring Analysis | Real-time | Wide range of supported assets including cryptos. Basic analysis details provided for free and has paid tools for screening and analysis. |

Delta app

Delta app is a crypto-focused tracking mobile app that is available globally for both iPhone and Android. Basic version is free, but it also has premium subscription.

FEATURES:

- linking up crypto exchange accounts as well as crypto wallets

- has some supported investments across stocks and ETFs

- portfolio summary view and breakdown by asset types

- asset details and news for supported investments

- price change notifications

PROS:

- first-class cryptocurrency support

- mobile native with pleasant design

- majority of features come for free

CONS:

- sparse data for stocks and ETFs

- no mutual funds or commodities support

- customers targeted to use eToro investment platform

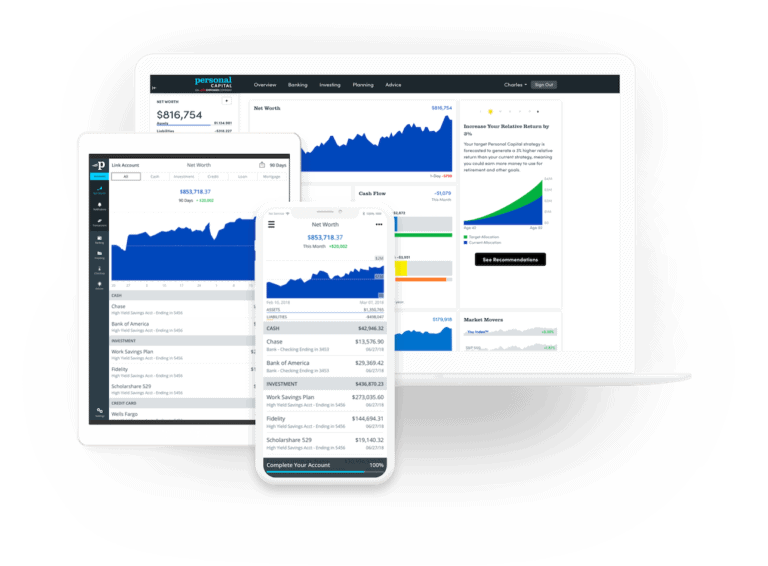

Personal Capital

Personal Capital is an established product that is available for US customers only. It provides a set of tools to manage your investments. One of them is investment portfolio tracking with number of features. This tool is free to use, exposed via web interface as well as mobile devices.

FEATURES:

- linking up brokers and banks to automatically synchronise your transactions

- net worth view including property valuation by post code

- portfolio performance charts and comparisons against benchmarks like S&P 500

- portfolio summary and category breakdown views

- portfolio check-up tool that provides asset allocation recommendations

- retirement planning tool

- mutual fund fees analysis tool

PROS

- still usable as a free option

- together with traditional investment types, it also supports cryptocurrency tracking

- few nice-to-have features (namely fund fee analysis and asset allocation recommendations)

CONS

- local, for US only

- customers targeted to use their wealth management service

Sharesight

Sharesight is an online portfolio tracker mainly for UK, Australia, New Zealand and Canada customers.

FEATURES:

- available globally with multi-currency support

- tax reporting reports

- dividends tracking for supported stocks

- summary and breakdown by segment views

- comparison against benchmarks

- price change alerts

- integrations with few supported brokers via trade confirmation emails

PROS:

- few interesting features (namely dividend tracking and tax reporting)

- safe solution to auto update your transactions via confirmation emails from few supported brokers

CONS:

- mainly for stocks/ETFs, virtually no mutual fund and cryptocurrency support (based on our test data and product documentation)

- only very limited mobile support via companion app, it’s mainly a web-based solution

- parts of user interface are somewhat outdated and slightly counter-intuitive

- severely limited free version, realistically paid version will be required

TotFin app

Totfin is a mobile app dedicated for investment tracking. All-in-one portfolio tracker for all investment types, that has vast investment selection and is available globally.

FEATURES:

- portfolio at a glance summary view with breakdowns by segment

- portfolio performance analysis, historical growth charts

- available globally with multi-currency support

- asset level drill downs and analysis

- registration-less unrestricted playground account after downloading the app

- elaborate gains/losses (Open P/L & Closed P/L for selected timeframes, segments, assets)

PROS:

- all-in-one portfolio tracker at heart, 200K+ investment selection across mutual funds, stocks, ETFs, cryptos and commodities globally

- simple, clean interface with clear at a glance summary across all levels (portfolio, segment, investment)

- privacy-first approach, only mobile phone needed for setup, no need to authorise broker access

- transparent: no ads, no marketing

CONS:

- New product on the market, TotFin app launched March 2022

- Dividends tracking not yet available

- Only in English language at the moment

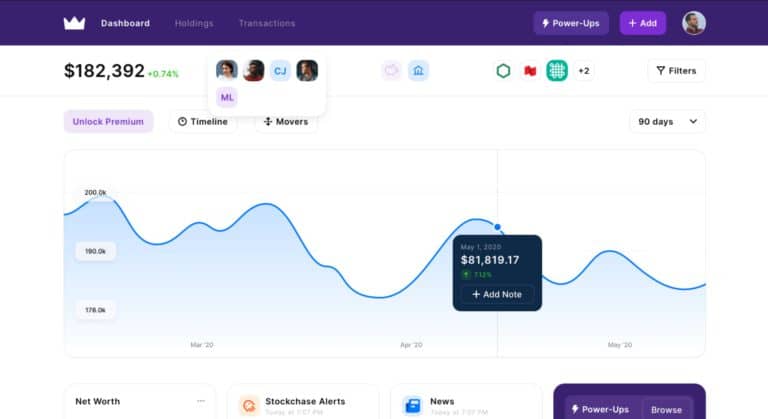

Wealthica

Wealthica is an investment tracking application for Canadian customers. It is available online and via iPhone or Android apps.

FEATURES:

- linking up brokers and banks to automatically synchronise your transactions

- performance comparisons against benchmarks like Dow Jones

- portfolio summary and category breakdown views

- portfolio performance reports

- advisory available with premium service

- Yahoo Finance integration by Wealthica portfolio import/export feature

PROS

- supports cryptocurrency tracking

- modern user interface

CONS

- local for Canada only customers

- premium version will be needed almost instantly

- you will have to integrate/authorise brokers, manually added investments are not updated

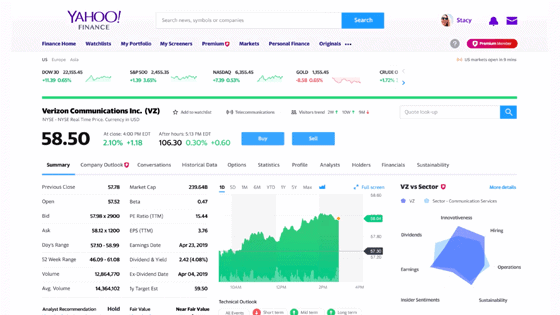

Yahoo Finance

Yahoo Finance is a rich watchlist which is mainly free and is available online via web interface, iPhone or Android app.

FEATURES:

- quality data across multiple investment types: mutual funds, stocks, ETFs, cryptos and commodities

- real-time updates

- asset fundamental details, news and commentary

- investment research and screening tools

- performance analysis

- ability to link certain brokers

- price monitoring

PROS:

- provides first-class in-depth data

- real-time updates, available globally

- rich set of features

CONS:

- weak or missing portfolio summary aspects: at-a-glance allocations summary, break downs, grouping

- mobile app has a very basic portfolio tracking view, it’s focused more on news, market data, upcoming events, etc.

- forceful about “enable sharing personal data with content and social media partners”

- ads and promotions

Other portfolio tracker applications

If you are interested to ‘have a look beyond the periphery’ 😂 – we have also provided some notes on applications that did not quite make the cut for us:

- Bloomberg watchlist: decent online watchlist powered by tremendous Bloomberg data, coupled with asset specific news. You can also access your watchlist via iPhone and Android mobile apps. It’s similar to Yahoo Finance, however we think latter is superior as Bloomberg has severe restrictions on free content and also does not support cryptocurrencies. Bloomberg’s subscription costs 340$ p/y.

- Mint: mobile first free budgeting tool for US and Canadians. Portfolio tracking is wrapped as a separate feature. You could link up several investment brokers accounts to get summary of your investments. However, it’s a budgeting orientated tool and portfolio tracking features are fairly limited. If you are looking from an investment perspective – Personal Capital (US) or Wealthica (Canada) will do a better job with analysis, comparisons, drill downs.

- Quicken: paid ($77.99 p/y) desktop (Mac and Windows) application for US and Canada. It has web access and companion iPhone or Android apps, but at the core – it’s still desktop. It’s sort of a merge between a budgeting and an investment tool and does have features like investment broker integration, summary and drill downs, performance comparisons and analysis. However, we think that for US and Canada customers, Personal Capital and Wealthica are superior from a portfolio tracking perspective. If you decide to have a look at Quicken, it might be worth having a glance at Moneydance as well.

- Morningstar: it’s a reputable tool for investment screening and analysis, however we excluded it from the best of all-in-one investment tracking tools. Its online user interface is very outdated, and for global users, it has gaps in data not only for mutual funds but also for ETFs. It also does not have any crypto tracking.

- Google Finance watchlist, Financial Times watchlist, MSN watchlist, SeekingAlpha watchlist – we think either YahooFinance or Bloomberg watchlists beats them – data or features.

We have dismissed several other asset trackers that either did not have even most of the baseline stock/ETF data or were simply buggy while testing them: “Atom Finance”, “EquityStat”, “genuineimpact”, “Kubera”, “Stifel Wealth Tracker”, “Utluna”. Also omitted trackers that come as a supplement to a main paid product, namely “SigFig” robo-advisor.

What investments did we use for testing?

We checked portfolio tracking applications with the following investments:

- Mutual Funds

- ISIN: IE00BJSPMJ28, Lindsell Train Global Funds plc – Lindsell Train Global Equity Fund D GBP Inc

- ISIN: US31618H3580, Fidelity Series Canada Fund

- ISIN: GB00B8N46C80, Invesco European Smaller Companies Fund (UK) Z (Acc)

- ISIN: US3163897826, Fidelity Advisor® Small Cap Value Fund Class M

- ISIN: US8085096738, Schwab Small-cap Equity Fund

- Stocks

- AAPL.US, Apple Inc.

- VOD.LSE, Vodafone Group Plc

- NAB.AU, National Australia Bank Limited

- DTE.XETRA, Deutsche Telekom AG

- AC.TO, Air Canada

- ETFs

- IITU.LSE, iShares S&P 500 Inf Tech Sector UCITS ETF USD Acc

- IVV.US, iShares Core S&P 500 ETF

- PPS.TO, Invesco Canadian Preferred Share Index ETF

- SPXP.LSE, Invesco S&P 500 UCITS ETF Acc

- A200.AU, BetaShares Australia 200 ETF

- Crypto-currencies

- BTC, Bitcoin

- LTC, Litecoin

- ETH, Ethereum

- DOGE, Dogecoin

- ADA, Cardano