What is a green ETF?

Green ETFs are ETFs that focus on investments that help with the green transition and make the globe greener. Green ETFs focus on companies that invest or create environmentally responsible infrastructure, energy efficient products, zero carbon emission products, renewable energy, forestation, coastal protection, etc.

In this blog we look at commodities that are needed to manufacture products and produce renewable energy.

Clean energy: transition from non-renewable energy

Here we will provide a quick context for our green ETFs.

The world needs to reduce its current carbon emissions

Non-renewable energy is powered by coal, oil, and gas, and is used for electricity, heating, manufacturing, transportation, etc. It’s the biggest contributor to global carbon emissions, hence we now “enjoy” this little greenhouse effect with all its current and upcoming side effects.

Renewable energy, or clean energy, does not have carbon emissions. That includes solar, wind, hydro, and other types of energies. Energy for electric vehicles (EVs), which are powered by batteries, also falls under that category.

Climate problems and public opinion became too serious to ignore and governments started to plan, legislate, and invest in technologies to shift from non-renewable energy to a clean energy. 150+ countries pledged to become carbon neutral by 2050.

How green is the green ETF?

Renewable energy needs to be produced somehow. Solar energy needs solar panels, wind energy needs wind turbines, electric cars need power batteries, etc. To create green infrastructure, materials like metals and minerals are needed. These materials in turn must be mined and processed as well. But are these sustainable and can such commodity ETFs be labeled as green ETFs? We argue that it’s not a clear-cut answer and it depends on the materials, quantities, and commodity production or processing approach.

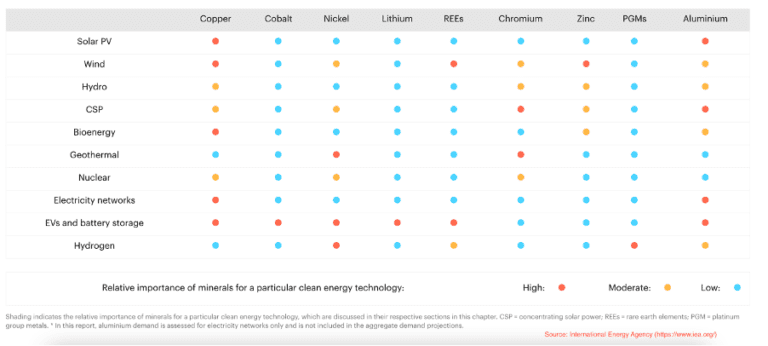

The International Energy Agency produced an interesting report on commodities required for green transition. This report shows which commodities are needed to transition to clean energy.

As we can see from the table above, number of minerals are needed to manufacture energy production or storage parts and creating the network infrastructure itself. Study published by Research Center of European Commission forecasts material demand and risks for Europe’s green transition. This study highlights critical raw materials that are needed for renewable energy migration as well.

We will review how green these pre-requisite materials, or commodities actually are.

ETF vs ETC: welcome to green ETCs

ETC stands for exchange traded commodity. It tracks the price of the commodity or commodity index. Technically it’s not an ETF, ETC is wrapped as debt instrument issued by an issuing company. In real terms, there is only a little difference between the two for individual investors, as both commodity ETFs and ETCs track commodity prices.

In our blog, green commodity ETF also means green ETC.

Commodities needed for green transition

We will have a look at commodities that are needed to create renewable energy and usage infrastructure.

Copper

Copper in industry

Copper is one of the most consumed metals already. It is considered the best conductor of electricity and heat. It is used in electronics, medicine, physics, agriculture, etc. You can find detailed statistics on current copper demand and supply here.

Copper in renewable energy

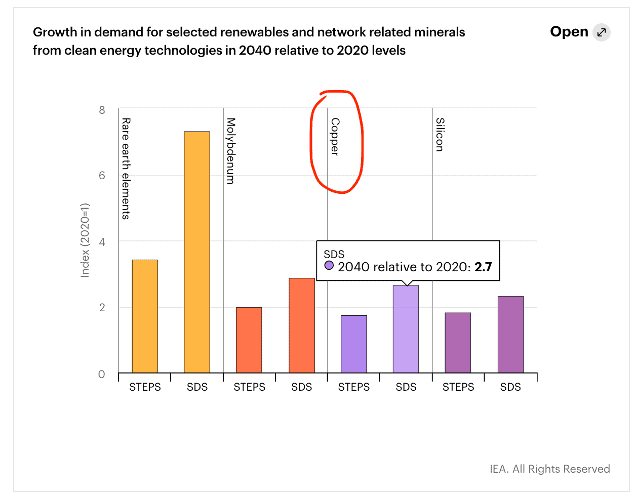

Renewable energy systems are heavily reliant on copper. It is needed for solar panels, wind turbines, EV batteries and electricity infrastructure. And the demand for renewables is expected to grow 2-3 times in the next two decades based on IAE report.

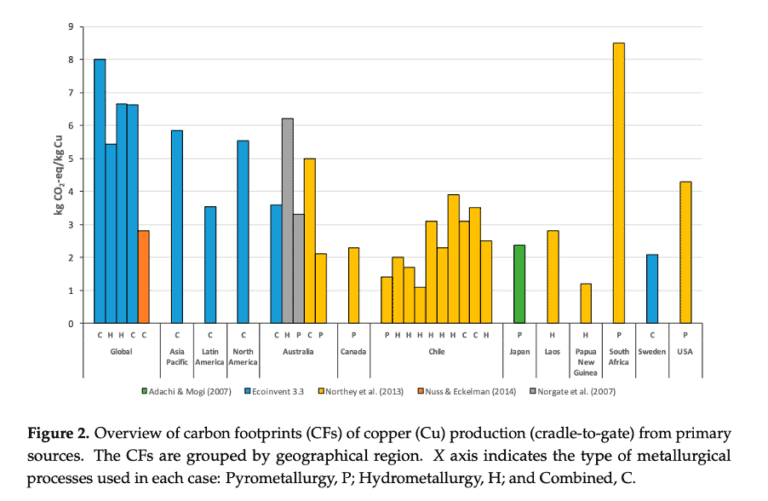

Copper production and sustainability

Copper is an abundant resource. It is a renewable resource itself, being 100% recyclable. Copper, like any other mined metal, has carbon emissions during production and refinement process. There was a detailed paper published on copper’s carbon footprint few years ago. It shows that 1kg of copper is linked to 1-8 kg of carbon emissions.

The copper mining industry is cleaning up itself with growing environmental awareness. For example, the El Abra mines in Chile are powered fully by renewable energy and has low carbon footprint.

Is copper ETF a green ETF?

Copper will help the transition to zero carbon emissions being an abundant resource and because it is recyclable and has a relatively low carbon footprint when produced responsibly.

Copper as green ETF: PASS ✅

Screen and track copper ETFs

You can screen for copper ETFs with justETF, etfdb, IG ETF screener.

Examples:

- Global X Copper Miners ETF (COPX)

- GPF Physical Copper ETC (TCUS)

- United States Copper Index Fund (CPER)

You can track your portfolio, including green ETFs and copper ETFs with TotFin portfolio tracker.

Aluminum

Aluminum in industry

Aluminum is a silvery-white metal found in aluminum sulphates. Aluminum has attractive properties such as being lightweight, noncorrosive, nonmagnetic, nontoxic, noncombustible, a good heat and electricity conductor.

Industries use it for electronics, vehicles, components in buildings, aircrafts, trains, vehicles, etc.

Aluminum in renewable energy

For green transition, aluminum is important as well. It is needed for power line infrastructure, electric vehicles and batteries, solar cells, etc.

Aluminum production and sustainability

It is a very common element on earth and it is 100% recyclable.

Aluminum production has 12-17 kg of linked carbon emission per 1 kg of material.

In the past, irresponsible aluminum mining had a negative effect to the environment including water and air pollution that affected local ecosystems.

In mining metals like aluminum, tighter regulations across a number of countries are being introduced to regulate its environmental impact. That steers aluminum production to be environmentally friendly with reduced carbon emissions, for example, production with the use of clean energy like hydro for electrolysis and extraction processes. Aluminum reusability rate is also increasing. The global aim is to reduce carbon emissions of aluminum production by 75% until 2050.

Is aluminum ETF a green ETF?

Aluminum is critical to renewable energy and green transition when produced responsibly.

Aluminum as green ETF: PASS ✅

Screen and track aluminum ETFs

You can screen for aluminum ETFs with etfdb, IG etf screener, etc

Examples:

- WisdomTree Aluminium (ALUM)

- iPath Series B Bloomberg Aluminum Subindex Total Return ETN (JJU)

- Aluminium TR ETC EUR (B4NP)

You can track your portfolio, including green ETFs and aluminum ETFs, with TotFin portfolio tracker.

Nickel

Nickel in industry

Nickel is a silvery-white metal with high resistance to corrosion. It is mainly used for making stainless steel and anticorrosive coatings.

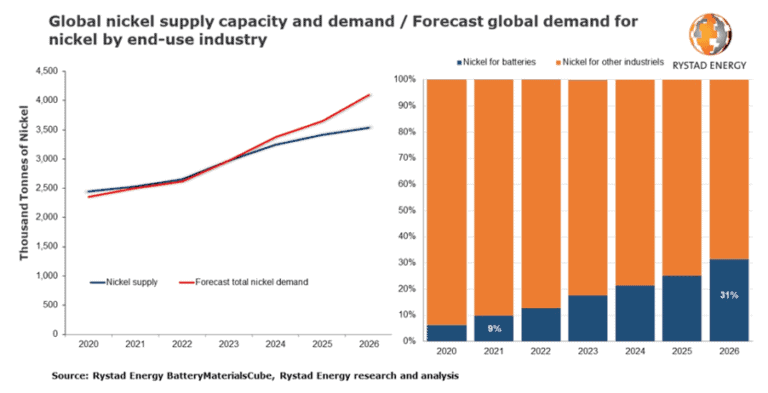

Nickel’s overall demand increase was projected for the next five years by Rystad Energy:

Nickel in renewable energy

In green transition context, nickel is also important as it is used for electric vehicle batteries. EV batteries currently make less than 10% of total nickel consumption.

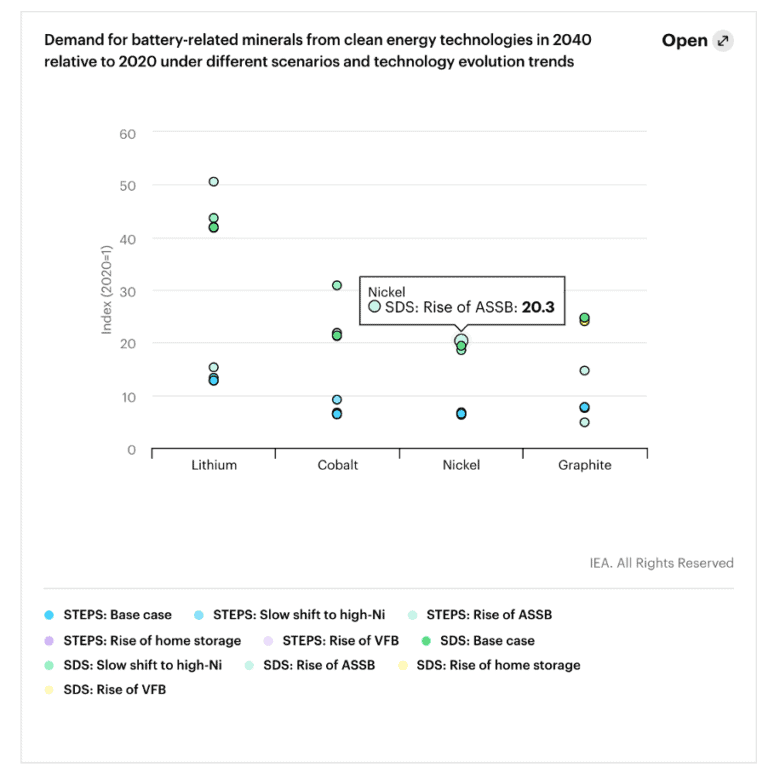

Nickel’s demand for EV batteries is forecasted to rise sharply. The IEA suggests 6-20 times demand increase in the next two decades based on several scenarios:

Nickel production and sustainability

Nickel is fully recyclable, but producing nickel creates a lot of waste as only small percentage of nickel itself is found in ore.

Nickel production has high carbon emissions. 1kg of nickel production is linked to 13kg of carbon emissions.

Nickel production is regulated to gear it the green way and suppliers selling nickel to the US and EU must comply with these regulations. It requires proving that nickel was produced in environmentally responsible manner.

However, actual current waste disposal practices are still a concern for the environment.

Is nickel ETF a green ETF?

Nickel is one of key elements in EV batteries and while electric vehicles reduce carbon emissions, the current nickel production is a concern from an environmental point of view.

Nickel as green ETF status: QUESTIONABLE 🤔

Screen and track nickel ETFs

You can screen for nickel ETFs with etfdb, justetf, IG ETF screener, etc.

Examples:

- Strategy of GPF Physical Nickel ETC (TNIS)

- iPath Series B Bloomberg Nickel Subindex Total Return ETN (JJN)

- WisdomTree Nickel (NICK)

You can track your portfolio, including green ETFs and nickel ETFs, with TotFin portfolio tracker.

Zinc

Zinc in industry

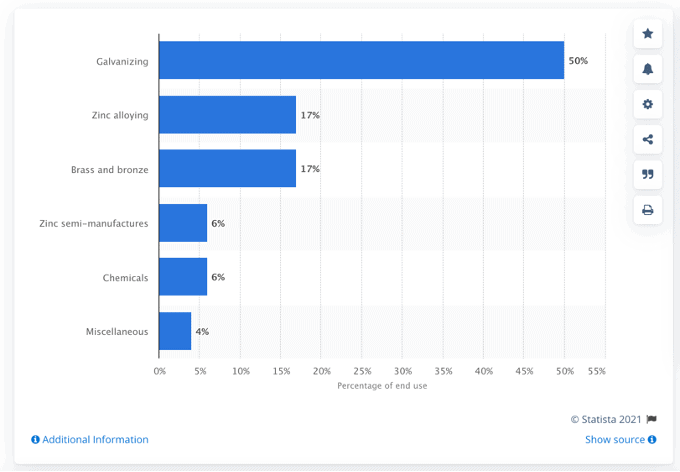

Zinc is a blue-white low toughness metal with moderate conductivity. Alloys of zinc prevent rusting and are widely applicable across various industries.

Zinc in renewable energy

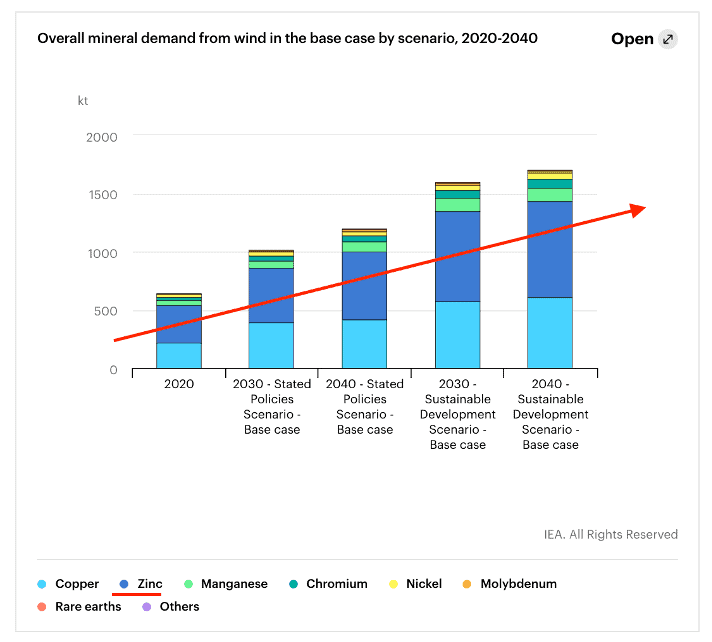

For renewable energy, zinc is primarily used for wind turbines. IAE forecasts 2-3 times increased demand in the next 2 decades:

Zinc production and sustainability

Zinc is abundant and it is fully recyclable.

1kg of zinc production will result in 3kg of carbon emissions which is relatively low in metals industry.

Is zinc ETF a green ETF?

Zinc is one of the key elements in wind energy. It will help with green transition if produced responsibly.

Zinc as green ETF status: PASS ✅

Screen and track zinc ETFs

You can screen for zinc ETFs with IG etf screener.

Examples:

- WisdomTree Zinc (ZINC)

- RICI EnhancedSM Zink TR ETC (BNQR)

- Zink TR ETC EUR (B4NS)

You can track your portfolio, including green ETFs, zinc ETFs, with TotFin portfolio tracker.

Lithium

Lithium in industry

Lithium is a silvery metal that is soft, light and melts in low temperature. Lithium is mainly used for batteries (electric vehicles, laptops, cellphones) but also has usage in glass and ceramics industries.

Lithium in renewable energy

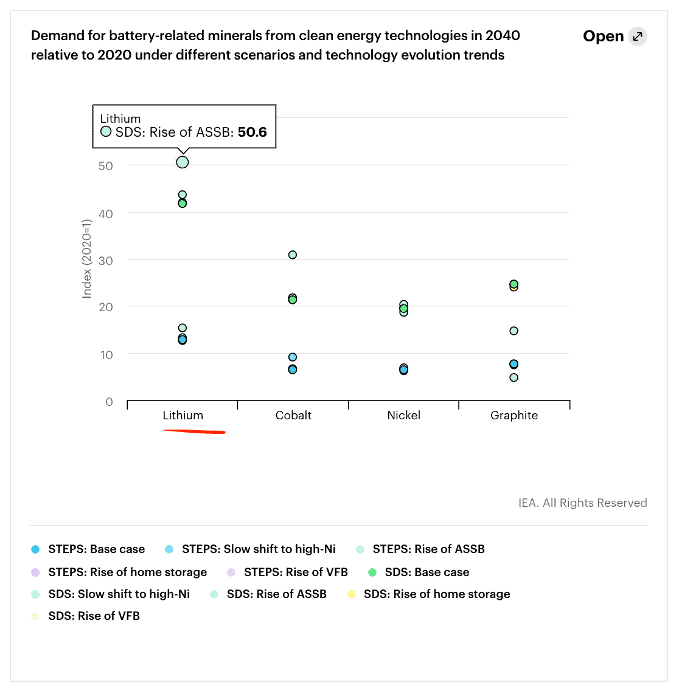

In the context of green transition, lithium’s main use is powering electric vehicles with electric energy. Lithium demand is projected to increase 12-50 times based on different scenarios unfolding over the next two decades:

Lithium production and sustainability

Lithium is found in underground clay, mineral ore, or underground pockets of water.

Extracting lithium from clay and ore has negative mining effects: waste, contamination, disrupted ecosystem. Extracting lithium from fresh water requires processing large amounts of water from streams and aquifers.

As shown previously, lithium demand is expected to rocket, and supply is expected to triple until 2025.

Given the current ecological situation and level of anticipated lithium demand, new technologies like “direct lithium extraction” or “extraction with ion exchange beads” are important to make lithium extraction much more environmentally friendly. Companies are looking to how to utilize these to produce lithium in a green way, i.e.: Energy Source, Lilac Solutions, etc.

Is lithium ETF a green ETF?

Lithium is one of the key materials for electric vehicle batteries. Lithium supply is a pre-requisite to shift away from vehicles powered by fossil fuels to electricity. Lithium is abundant and it can be produced in an environmentally friendly way.

Lithium as green ETF: PASS ✅

Screen and track lithium ETFs

You can screen for lithium ETFs with IG etf screener.

Examples:

- Global X Lithium & Battery Tech ETF (LIT)

- ETFS Battery Tech and Lithium (ACDC)

- Amplify Lithium & Battery Technology ETF (BATT)

You can track your portfolio, including green ETFs, lithium and battery ETFs, with TotFin portfolio tracker

Summary

When it comes to ethical investing and green ETFs, labeling commodity ETFs is not always straightforward. While metals like copper, aluminum, nickel, zinc, and lithium can help reduce carbon emissions, mining and refining these materials is still linked to large carbon emissions as well as environmental damage.

Note that a commodity ETF is an investment wrapper for the materials themselves. The same materials can be produced by different companies in different regions that have different practices, regulations, values, etc. For example, the ‘greenness’ of lithium produced by mining ore is very different from the ‘greenness’ of lithium produced by geothermal brine extraction, processing, cleaning and and re-injection.

In summary, there is no argument against commodity investing, however as a green investor, it is important to look at how ‘green’ the production of individual commodities is.