How to choose the best mutual funds portfolio tracker app

In this blog we will determine how to select the best mutual fund portfolio tracker app that fits you. We consider:

- What is a mutual fund?

- Which mutual fund portfolio tracker applications can track ALL your funds?

- Mutual funds vs investment funds

- How are mutual funds priced?

- What are the key mutual fund portfolio tracker app features?

- What are other important selection criteria to choose mutual fund portfolio tracker app?

- Is it worth having all-in-one portfolio tracker application?

These aspects have been considered in our analysis with summary:

What is a mutual fund?

A mutual fund is an investment fund that has pooled investors’ money and is managed by fund managers.

Mutual funds can be classified into a number of different categories based on different factors like underlying assets, structure, or investment goals.

Based on underlying assets, mutual funds can be categorised into:

- Equity funds that invest to stock market and target companies across different industry sectors, regions, sizes, etc.

- Index funds that focus on simply tracking various market indices (i.e., FTSE 100) by holding assets that compose that index

- Money market funds that invest to low-risk short-term liquid debt instruments (i.e., T-Bills)

- Fixed income funds which have underlying assets that provide fixed income, i.e.: (i.e., bonds)

- Other mutual funds like hybrid mutual funds (i.e., merge between equity and fixed income focus)

Mutual funds shares are available to trade for small investors via investment brokers (i.e.: for UK, it could be Hargreaves Lansdown, Interactive Brokers, etc.).

Which mutual fund portfolio tracker applications can track ALL your funds?

How to find your mutual funds in a portfolio tracker

The common problem with mutual fund portfolio tracker apps is that they do not have enough data. If any of your mutual funds is missing, the purpose of having a separate application where you consolidate all mutual fund data is compromised. Also, search results might be ambiguous: a mutual fund data may not be found because it’s unknown or because a wrong fund identifier was used. And if a mutual fund was found, how do we then make sure that it’s the exact same mutual fund that we searched for?

How to identify your mutual funds in a portfolio tracker

Mutual funds are not listed on exchanges directly and each will have multiple identification numbers. A mutual fund can be identified by different identifiers (i.e., SEDOL in UK, CUSIP in US, FIGI for Bloomberg adopters, etc.) but generally it will have:

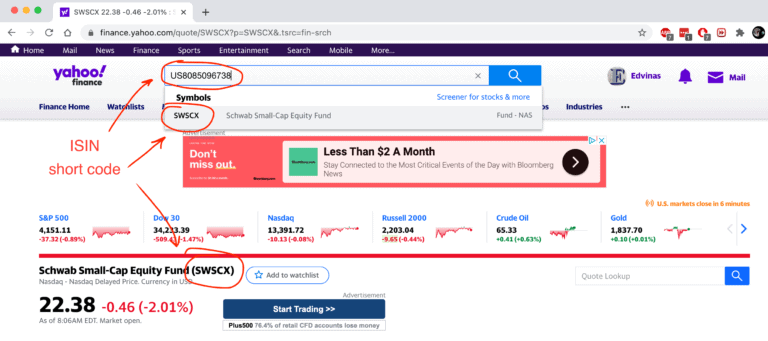

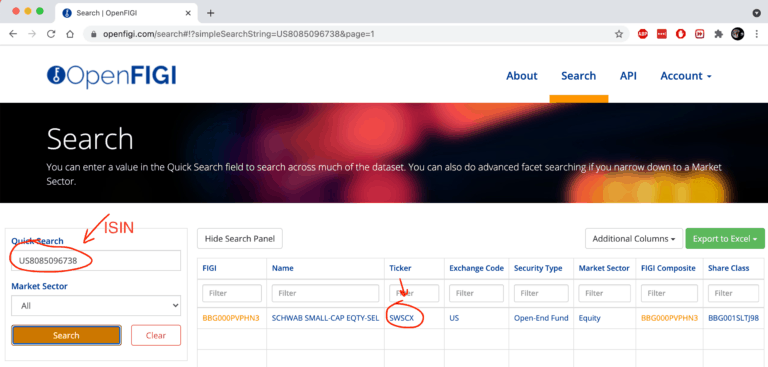

- an ISIN number, which uniquely identifies that fund globally

- a short code, which can have different formats (i.e., for US funds tickers, five symbols ending with X like “FCVTX”, “SWSCX” are used)

ISIN: “US8085096738” (ticker: “SWSCX”): identifies “Schwab Small-Cap Equity Fund” mutual fund to track

Some portfolio trackers support search by ISIN, which you can find in your mutual fund broker’s fact sheet or find directly under the mutual fund’s issuer’s notes (i.e., Fidelity identifiers).

If a portfolio tracker doesn’t allow searching by ISIN, you can generally search by the fund’s short code. To find it, you can look it up by ISIN in Yahoo Finance or Bloomberg’s OpenFIGI.

ISIN based mutual funds search should help to clearly identify the asset. Our shortlisted mutual fund application trackers support that capability.

We have online mutual fund search capability by ISIN, CUSIP, code, name, etc. on our backlog. Vote if you wish us to get it delivered for you.

Mutual funds vs Investment funds

Mutual fund VS Hedge Fund

An ‘Investment fund’ generally implies that it is a mutual fund is being referred to. However, we also have hedge funds which are pooled money, managed privately and not open to the public. Hedge funds data is less accessible and generally portfolio trackers will not have pricing information if you own such funds.

Mutual fund vs Close-Ended Fund

Based on structure, mutual funds can be categorised into:

- Open-Ended funds – the most common mutual fund structure by far, where investors can trade mutual fund shares at their net asset value (NAV).

- Close-Ended funds (CEFs) are more similar to publicly traded stocks. CEFs have fixed number of shares issued during IPO which are then listed on exchange to be available for investors to trade directly.

Generally, the term ‘mutual fund’ means Open-Ended mutual fund, while Close-Ended mutual fund would be referred to as CEF. For the purpose of this blog, we use ‘mutual fund’ term to denote Open-Ended mutual fund.

Open-Ended Mutual fund vs Close-Ended Fund vs Exchange Traded Fund

ETFs (Exchange Traded Funds) are similar to stocks. They are traded on stock exchanges throughout the day, same way as stocks are. They are passively managed investments which have underlying assets replicating stocks of the index that they track (i.e., holds FTSE 100 companies shares).

Open-Ended mutual funds however are not available on stock exchanges but rather on issuing fund companies via brokers. Fund managers actively manage mutual funds, which means usually it has some management fees applied. They also priced once per day rather than intraday as ETFs.

Close-Ended funds are also actively managed by fund managers same as open-ended mutual funds. However, they have a fixed number of shares and are listed on stock exchanges. Value is driven by supply/demand and liquidity, so unlike open-ended mutual funds they can be traded with discount or premium to NAV (their underlying asset value). Close-Ended funds and ETFs are both traded on stock exchanges, but ETFs just track index/sector so therefore are managed passively while CEFs are managed actively.

Portfolio trackers can support one or more of these products. It is common that all ETFs, CEFs and mutual funds will be all covered by all in one portfolio trackers.

How are mutual funds priced?

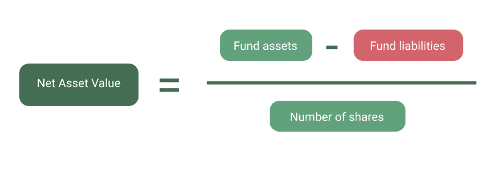

Mutual fund shares are priced as net asset value (NAV) at the end of trading day and based on actual underlying mutual fund assets prices.

NAV is a fund’s underlying assets value minus fund’s liabilities and divided by the number of fund shares.

Mutual funds share prices (NAVs) are publicly available and can be tracked by portfolio trackers. When mutual fund prices change, portfolio trackers can show accurate daily valuation updates of your portfolios.

What are the key criteria to select a mutual fund tracker app?

Does it support all your mutual funds?

It’s probably the most important question. If you have multiple mutual funds that are issued by different companies and bought via different brokers, chances are that your chosen portfolio tracker will not have some of your mutual funds. To confirm that a portfolio tracker app is in discussion for selection, it would need to support all of your mutual funds.

In fact, it’s not always easy to even identify if your mutual fund data is available in your portfolio tracker. You can find our guide on how to uniquely identify a mutual fund based on ISIN and avoid ambiguity in your portfolio tracker.

What mutual fund tracker app features are important to you?

Apart from an all-in-one view, portfolio trackers can provide some nice extra features in comparison to native trading broker apps:

- Mutual fund fee analysis

- Support of different asset types (stocks, ETFs, commodities, cryptocurrencies)

- Price monitoring and alerts

- Mutual fund portfolio baseline comparisons (i.e., against FTSE 100)

- News, analysis, screening/research

- Growth estimations

- Available devices

You can find more about common portfolio tracker features here.

What are other important selection criteria in choosing a mutual fund portfolio tracker app?

Consider an all-in-one portfolio tracker app

Your investment portfolio might consist of multiple investment types which goes beyond mutual funds. That could include stocks or ETFs across different exchanges, crypto currencies, commodities, and others. If that’s the case, it might be worth considering an all-in-one portfolio tracker application that also includes mutual funds. We highlight key things to consider and apps comparison summary here.

Which is the best mutual fund portfolio tracker application?

Yahoo! Finance

Yahoo Finance: vast selection of mutual funds powered by quality Yahoo data. It provides mutual fund’s fundamental data, related news with paid version providing further insights, analysis and screening tools. You can find detailed features, pros and cons review with comparisons here.

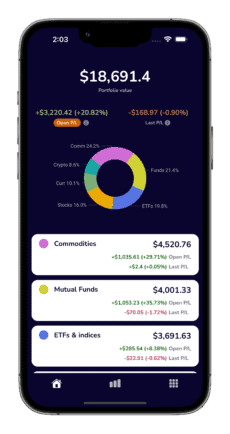

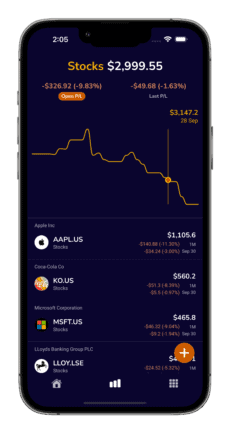

TotFin

Yahoo Finance is great, but it is geared more towards news, market data, upcoming events and misses common expected portfolio tracking capabilities like portfolio summary, total/daily gains, grouping by segments, drilldowns, etc. It is also heavily polluted with ads/promos and portfolio tracking mobile app experience is poor.

For the lack of top-quality global portfolio tracker mobile app with good mutual funds support, we created TotFin app. It is a product that aims to address mentioned issues. TotFin will have rich mutual fund selection (30K+) across all regions and has a number of features in the roadmap that are available for voting to shape it based on your votes. Even if you are not able to find your mutual fund, TotFin accepts requests and usually processes it to be available in few days.

Others

We have reviewed a number of portfolio tracker applications and you can find full detailed portfolio trackers comparison here. This contains several other applications that you might find fit. Our sample testing data used for number of portfolio trackers showed that absolute majority claiming mutual fund support don’t actually have enough data, which defeats the purpose of aggregated tracking. If you are looking to consolidate mutual funds tracking and require wide mutual funds selection globally, Yahoo Finance or TotFin could help.