Growth investors: the profile

Growth investors focuses on investments that have high potential to grow. They get returns through the capital gains when selling the stock rather than receiving dividends and re-investing. We will look at some of the fundamental analysis metrics for growth stocks that are also applied for stocks, ETFs, and mutual funds.

What is considered a good investment for a growth investor?

Key metrics for growth investing

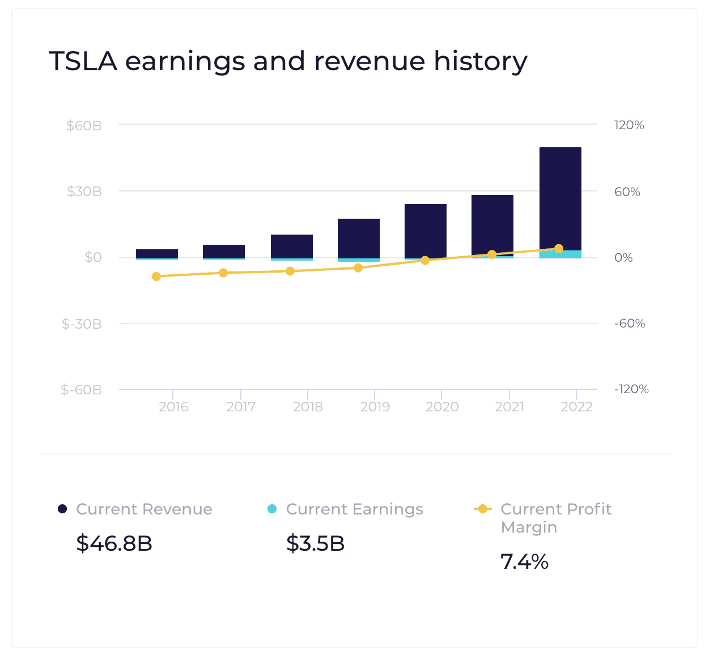

Let’s have a look at the most important growth indicators and use Tesla as our growth example for this blog.

We will use WallStreetZen to illustrate the metrics. There are other free tools that you could have a look at: Yahoo Finance and Thomson Reuters.

Some of the metrics used for growth investing will be identical for value investing as well. We detailed key fundamental analysis metrics in this blog.

Profit growth (EPS ratio)

Earnings-per-share ratio indicates company profit per share. It is calculated by taking the net profit and dividing it by the number of shares.

Growing EPS will push the share price up, however, note that the number of company shares might change overtime as well. The most common example is a company issuing additional shares which in turn increase the number of total shares (share dilution). If the number of total shares increases, the EPS ratio will automatically decrease. To avoid that, ‘basic EPS’ is commonly used to mitigate share dilution impact and distorted EPS ratio.

As a growth investor you would be looking at a historical EPS growth. Growth expectation will vary based on company size as well. For more established companies, growth rate might be slower compared with the younger companies whose market share are increasing more rapidly.

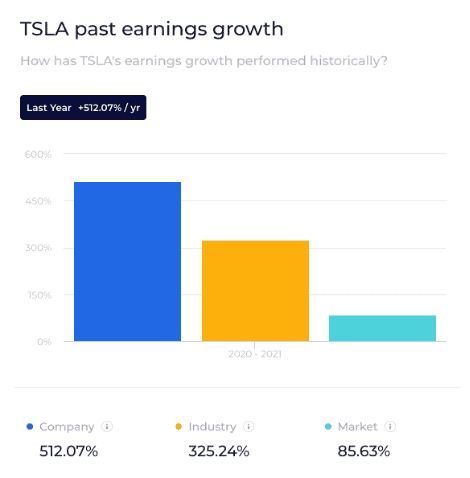

As we can see, Tesla’s earnings have been steadily improving and it has managed to change losses to profits. Last year, its EPS exploded to 500%+ – outperforming the industry as well as the market benchmarks

Market valuation based on earnings (PE ratio)

Price-to-earnings ratio, or PE, indicates how the market values a company in respect of its earnings. It might be calculated based on either profit per share or total company profit but results from both should match. For example, PE can be calculated by dividing total company price by total company earnings.

PE ratio shows how prices correlate to company earnings. This will give you an indication how a company is valued. It’s also very useful to compare it against benchmarks (i.e.: competitors in the same industry).

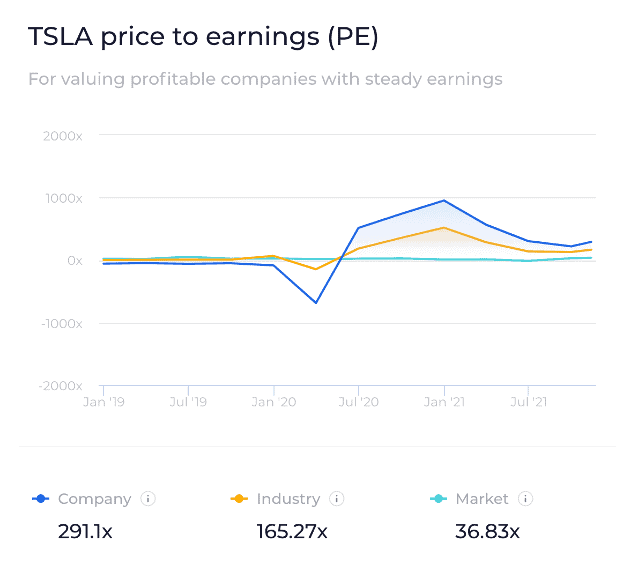

An acceptable PE number for a growth investor will be different depending on the sector. Growth companies also tend to have much higher PE as it has embedded future earnings growth expectation.

Value investors commonly look for a PE below 25 while growth investors do not restrict themselves with such threshold and could accept higher PE. For example, when Tesla had PE around 1000, growth investors were happy to overpay for the shares because they anticipated rapid future growth.

PE ratio also comes in different flavors. In the above example, we have twelve months trailing (TTM) PE which is calculated based on the results from the last four quarters of company financial reports. There is also a ‘forward PE’ which is calculated based on predicted or future earnings. Predictions might be skewed and will vary, but for a growth investor it might be interesting to see earnings growth forecast.

Profitability based on equity (ROE ratio)

Return on equity ratio, or ROE, indicates how efficient a company uses its equity to generate its profit. We calculate it by taking net income and dividing it by equity.

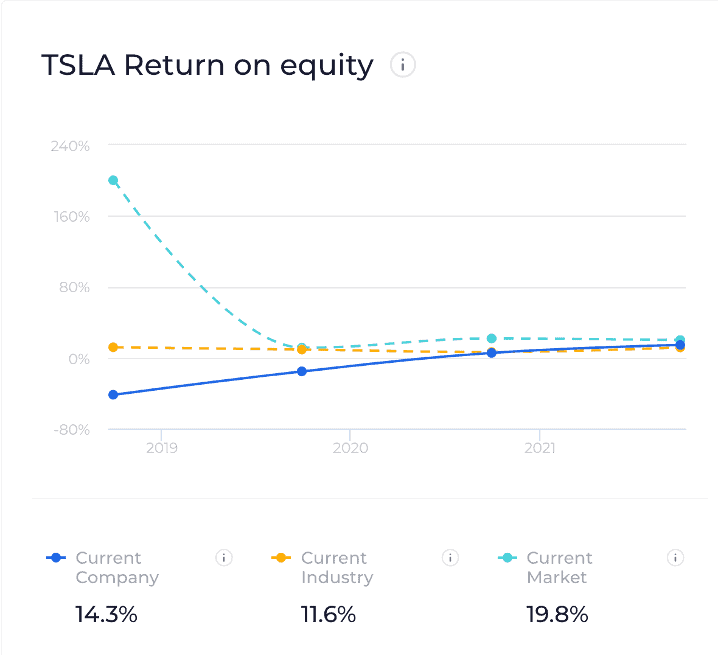

ROE shows how profits correlate to the equity. You could anticipate that if a company grows its equity by reinvesting to its growth, the company earnings will grow as well. The growth of the earnings could be anticipated to correlate to the ROE ratio.

In our Tesla example, the ROE was continuously improving and forming a positive trend. An improving ROE means that a company is utilizing its equity efficiently.

Debt (DE ratio)

Debt-to-equity ratio, or DE, tells a growth investor how much debt the company has in respect to its total equity.

It is calculated by dividing company debt by equity (assets minus liabilities). There are multiple ways to calculate DE and basically it depends on what liabilities we take into consideration, for example, short term debt vs long-term debt.

As with the majority of ratios, DE ratio benchmarks varies based on the respective industry.

In our Tesla example, we can see that its equity grew rapidly while its debt increased slowly. This improved its DE ratio heavily. The ratio is below one, which means that if Tesla were to liquidate all assets, it could cover all liabilities and still have remaining funds to distribute amongst the shareholders.

How to screen growth stocks

There are several products you could choose.

Yahoo Finance screener has always been a good free option. It gives you a myriad of filtering options based on your selected metrics.

Recently, I came to like WallStreetZen. They have a user-friendly interface and does not overload with analytical information. Instead, they focus on presenting key data.

How to track growth stocks?

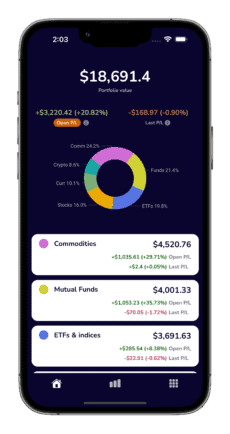

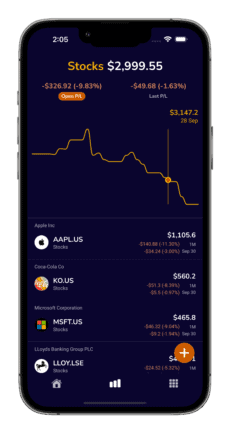

TotFin portfolio tracker app has a user-friendly interface to track your investments regardless of whether it’s growth stocks, value ETFs or green energy mutual funds.

Growth investor vs Value investor

Growth and value investing metrics are theoretically the same. The difference is how we interpret these metrics and what are we looking for. We use fundamental analysis metrics with qualitative analysis to screen for these investments. Analysis requires a lot of time and you will have to compete with the financial market, so finding true investment values is tough. It is the same market that has banks pouring resources into machine learning or quantitative analysts’ research, and the same market where some participants just follow trends because of the fear of missing out.

Being able to understand key fundamental metrics is a useful skill to have, and you can apply that knowledge not only to evaluating growth or value stocks, but also ETFs, mutual funds and to your investing approach in general.

Growth vs value investing has always been presented as relatively similar and adopting either approach is a personal choice to make.