Be more efficient with digital apps

When we talk about financial health, the most common themes that come out include balance among spending, saving, budgeting and investing.

It might seem that our lives revolve about securing resources for our short- and long-term expenses such as rent or a house mortgage. People may claim that their work or career is the pillar of their financial aptitude, but this shouldn’t always be the sole case. It is not a secret that improving or maintaining financial situation requires a balance of every other aspect of a person’s well-being, and yet it remains hard to convince most of us not to brush off all the other life activities that are linked to financial health just because they don’t seem to produce the monetary output like a salary (ahem, like cooking for yourself).

Let’s talk about some of the practices that are linked to improving financial health and which you can try incorporating in your day-to-day activities.

Using online apps for grocery shopping

You can select one day and assign it as your major shopping day where you buy your essential groceries like your weeks or months’ worth food, drinks or cleaning materials. One great way, based on our experience, is to do this via an online grocery service. An online option allows you to categorize necessary items which you constantly need to have at home like kitchen items, bathroom items, food cupboard items, etc. and you can just click them into your cart or set that by default without any distraction from other products. Setting-up a weekly or monthly schedule for delivery is very convenient in terms of reminding you what your lists look like or what you might have missed, and therefore sparing you time manually listing these items on repeat. Also, one of the most common scenarios which we can all relate to while doing a daily or regular on-site shopping is the unnecessary spending neighbouring aisles’ items. These might be simple items but can accumulate to a tangible worth spends in a month.

The best feat about ordering big groceries online is the amount of time we can save doing them. It isn’t about being lazy, but we know that money = time.

Convenience is of utmost importance. We all experienced driving or travelling to the grocery store, walking around trying to find the same items, joining a long queue, and then carrying the heavy bags to your car or home. On top of that, you find items you later regret buying (junk food) but couldn’t resist because it looked irresistible in real life. It might look a bit risky at first since you don’t want low quality items to be delivered to you and this is where your due diligence on picking the right grocery provider comes in. You can practice this recommendation based on the mentioned benefits without, of course, jeopardizing your security, actual needs or what is truly convenient for your lifestyle. The bottom line is that this exercise can help save not only money but also time and energy.

Subscribing to a home meal delivery service

Compared to buying food daily, home cooked meals are the best budget saver. The real hurdle is the time and effort you must spend making them. But home cooked meals don’t always have to be time consuming. Try creating or selecting meal plans which only takes 10-20 minutes to cook and which you can easily do. One recommendation is to choose and subscribe to a meal delivery service who provide fresh and accurate measurement of ingredients. Personally, I find this budget friendly because I am not forced to buy unique spices or ingredients in bulk which are only used once and expires before you have the chance to use them again. It wouldn’t feel like a chore considering the time you’d need when to go and queue from a fast-food or a café. The best take from cooking home meals is how healthy and how cheap they can be all at the same time! Bonus points for your pockets and fitness.

Fitness apps

You can only whip yourself at work for too long until your body starts failing you. The gym is a great place to keep yourself up and about, but many find this either expensive or time consuming. But if you can spend a full day on the sofa, why not do 30 minutes of physical activity at home with a readily available and accessible fitness app? At the end of the day, your are doing nobody this favour but yourself only.

There are abundant fitness apps which you can subscribe to in replacement for a gym membership. The key thing to consider is your motivation and your lifestyle. Fitness apps are comparatively cheaper than gym memberships and wouldn’t impose 6 to 12 monthly contracts or limit who you could bring with you to join your work out. If you are looking to save time, fitness apps offer home workouts which can suit your place, or whether you need equipment or not. In most cases, people pay for gym membership to motivate them to attend gym but at the same time would hesitate to leave their home or attend them afterwork for some common reasons such as travelling to the gym or bad weather.

Having a hybrid solution works as well and would probably be suitable for a lot of situations. The key thing is that maintaining fitness help you keep your mind clear and sharp about deciding on or handling your finances better, especially that finances are stated to have impact on physical and mental well-being. A home fitness app is a very convenient way to have the physical fitness aspect of your financial health within your reach, your time, and your budget.

Choosing debit cards over credit cards for purchases

It might feel unpleasant to tap directly into your debit card and watch your balance decrease whenever you purchase something. But delaying what is inevitable thru a credit card does not make any difference if you will pay more for interest. Again, when you use credit cards and don’t pay in full, you pay more. Based on personal experience, 0% interest credit cards will start charging higher interest rates after 6 to 12 months starting with 0% interest. We have tackled in our personal budgeting blog on why it is helpful to avoid using credit cards for regular or day to day purchases, and concluded that using debit cards instead help you comprehend your actual budget and therefore spending capability. It does not mean that all credit cards always affect you negatively, you can hold on to them if you need to build up credit score, purchase insurance or when you truly need credit in times of emergency or important life events.

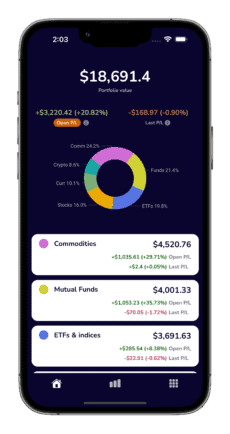

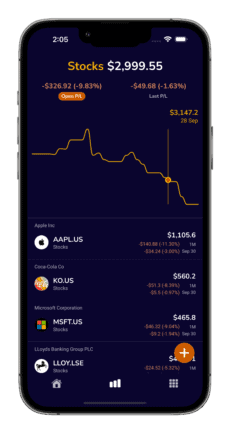

Utilizing apps in tracking your assets or portfolio

Consolidating all your assets into an all-in-one portfolio tracker app is a very convenient way of monitoring them. You might relate to not checking all your apps (you might have a crypto wallet, an ETFs investment tracker app, stock tracker watch app, etc.) every single day and probably only check your most watched assets or investments majority of days, like if you recently bought into a stock hype like Dogecoin, you’d probably just keep opening a crypto wallet app during the day and then tend to neglect monitoring your other small or long-term investments. But if you would have an all-in-one portfolio tracker app, you would be able to distinguish all your assets and investments performance on a frequent basis without spending too much time.

All-in-one portfolio tracker apps would massively help you be aware and updated of all your assets and investments and across different investment types and how they are faring among each other, where your daily gains and losses are coming from. Most of all, having an all-in-one portfolio tracker app gives you the chance to hit and optimize potential gains and avoid foreseeable crashes at the right time because you are informed regularly. Feel free to read about all-in-one portfolio tracker features in our all-in-one portfolio trackers comparison blog.