Understanding DeFi cryptos: crypto refresher

To understand DeFi cryptos topic, you will need some crypto knowledge. If you wish for a quick refresher on cryptocurrencies: what is a Blockchain, exchange, wallet, how are the cryptos mined, traded, staked and such – have a look at our “How do cryptocurrencies work” blog.

Centralized Finance, or CeFi

Centralized finance means centrally managed finances.

In traditional banking you have central banks (i.e.: Federal Reserve in US, Bank of England in UK, etc.) that are responsible for steering monetary policy. To influence the economy, they have certain tools at their disposal, including manipulating interest rates, quantitave easing (a.k.a money printing), etc.

In the crypto world, CeFi (centralized finance) is used in the context of crypto exchanges. Binance, Kraken, Coinbase all are central exchanges (CEXs), where crypto traders can execute operations such as trading cryptos or exchanging them to fiats. Users don’t need to interact with each other, and all transactions go through CEX. This is ought to increase user security and convenience.

DeFi, or Decentralized Finance

Okay, so what is the difference between centralized and de-centralized?

De-centralized means NOT managed centrally. Cryptos inherently are de-centralized as you have a main transaction ledger where no single authority can make changes. A ledger is run by thousands of independent nodes that are not controlled by any governments or banks. For more details on how do cryptos work click here

In the context of cryptos, DeFi is a parallel universe to what we are used to with conventional banking, i.e.: crypto loans instead of bank loans, crypto interest rates, crypto derivatives, crypto bonds, crypto insurance, etc.

DeFi vs CeFi: context for DeFi cryptos

Cryptos took off a while ago.

Initially, the centralized traditional banking sector looked down on it, but public interest and astonishing gains influenced banks to consider jumping the bandwagon and governments realized it as a treat that needs to be mitigated.

As a result, we have strong international traditional players like Barclays, JP Morgan, Citibank and others investing into hybrid crypto platforms themselves. Facebook (apologies, Meta) even created Libra (apologies, Diem) digital currency.

As cryptos became popular, governments were forced to impose cryptocurrency regulations due to its unregulated nature. It is still evolving, and different countries have different crypto regulations. The key issue is that the anonymous nature of cryptos and crypto payments makes it hard to impose capital gain tax on crypto users.

Also, decentralization itself is a risk to a traditional banking system. The number of cryptos in the market are well defined. It is based on algorithm and there is no authority that can change that. Even though cryptos are still very volatile for different reasons, conceptually they are very different from conventional currencies. Central banks can unanimously use techniques like quantitave easing (QE) to rapidly increase amount of currency in the market.

DeFi is evolving and CeFi is adjusting.

DeFi exchanges (DEX)

DEX, or decentralized finance exchanges, is where transactions are made directly between a buyer and a seller.

As opposed to CEX (centralized exchanges like Binance or Coinbase), users don’t need to have an account and can make transactions directly.

DeFi exchange vs CeFi exchange

DeFi exchange pros:

- Users do not need bank accounts

- Users are not required to provide any personal details

DeFi exchange cons:

- No fiat trading

- No security blanket for support (fraud, technical issues)

- Low adoption (number of users)

- Less friendly user experience

- Slower transactions speed

Trading DeFi cryptos, how does it work?

DeFi applications are based on decentralized networks like Ethereum.

DeFi crypto exchanges has these key components:

- Smart Contracts – they are digital contracts that are triggered in certain conditions. A smart contracts code is open source (anyone can see how it works), it triggers itself on the network automatically and it can’t be changed or tampered.

- Decentralized applications (DApps) – this is the engine of DeFi, it is composed of multiple smart contracts to execute a certain logic. Effectively, it can be any DeFi application that runs on Ethereum network. This is what unlocks the DeFi potential: applications that allow trading, lending, derivatives, etc.

What is the most popular DEX exchange for DeFi crypto trading?

DeFi is still in its very early stages, different providers give different trading volumes for the same exchanges across the same period.

At the time of writing, the most popular DeFi crypto exchanges seem to be UniSwap, Pancakeswap and DyDx.

Sample DeFi crypto trade with UniSwap

Okay, let’s see DeFi crypto trading in action.

Note: this is purely experimental, by no means we suggest using DeFi crypto trading. It has still a long way from maturity and the example below is merely a curiosity exercise.

- Connect to the wallet

2. Select trading pair

3. Trade

4. Confirm transaction on your wallet

5. At this point I decided to cancel the transaction as the miner’s fee for $1 transaction is $194 😱

I also tried to use Pancakeswap, here are my results:

- I could not execute a BNB trade, as my BNBs in Atomic Wallet were not being recognised in Pancakeswap DEX. I have found out that this is related to BEP-2 and BEP-20 standard differences.

- I could not execute ADA trade as I needed to import token definitions and DEX showed a warning “Anyone can create a BEP20 token on BSC with any name, including creating fake versions of existing tokens and tokens that claim to represent projects that do not have a token.”

- I could not execute Ethereum trade as I needed to connect to my “Coinbase wallet,” but PancakeSwap does not support a “Coinbase Wallet” connection. A generic connection called “WalletConnect” can bridge other wallets to Pancakeswap but “Coinbase wallet” unfortunately does not support it.

Also tried DyDx DeFi crypto exchange (DEX):

- I could not execute an ADA trade as well. DyDx exchange has a two-step wallet connection process (connection and authorization steps). DyDx got stuck on step 2 (authorization) with “Atomic Wallet” which I used.

Decentralized finance: the future of alternative crypto universe

It’s still the very early stages of DeFi crypto trading. After a few tries with the abovementioned DEX exchanges, I personally would use CEX exchanges (Coinbase, Binance, etc.) for now.

However, it will be very interesting to see what the future brings for DeFi. DApps are growing and once they start maturing, we might see a wave of unconventional use cases, #borrowThatNftArt.

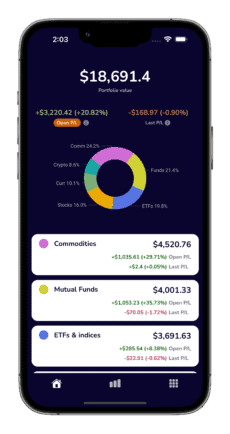

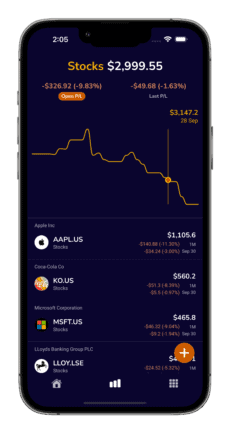

Tracking cryptos

Too track any coins or tokens you can use Totfin app, which is an all-in-one portfolio tracker tool. You can track not only cryptos, but also traditional assets (like ETFs, stocks, mutual funds, commodities) if you have them in your portfolio.