Understanding how cryptocurrencies work

Let’s shed some light on how cryptocurrencies work.

- Crypto glossary

- What is a cryptocurrency?

- What is Blockchain and why is it important for cryptocurrencies?

- How is a cryptocurrency created?

- Cryptocurrency features

- What are the most popular cryptocurrencies?

- What is a crypto wallet?

- What is a crypto exchange?

- Crypto exchange vs Crypto wallet

- What is a crypto portfolio and how is it tracked?

Let’s recap:

Crypto glossary

We will reference and elaborate following terms below:

| Cryptocurrency | Digital currency |

|---|---|

| Crypto | Synonym for cryptocurrency |

| Coin | Cryptocurrency unit |

| Bitcoin | Most popular coin |

| Satoshi | Smallest unit of a bitcoin, equivalent to 100 millionth of a bitcoin |

| Fiat money | Government issued currency |

| Blockchain | Backbone technology for cryptos |

| Blockchain ledger | Digital ledger of all cryptos owned and transactions ever made |

| Consensus mechanism | Blockchain mechanism to determine valid transactions |

| Transaction block | Set of transactions that are verified and processed in one batch |

| Nodes | Machines with crypto software that power Blockchain technology |

| Mining | Process of creating new coins |

| Staking | Holding cryptos for pre-agreed time to receive rewards |

| Private keys | Uniqueue character string that proves ownership of cryptos listed in the ledger |

| Immutable transaction | Ledger transaction that cannot be undone or reversed |

| Crypto wallet | Means to hold private keys that prove coins ownership |

| Crypto exchange | Crypto market places for trade execution |

What is a cryptocurrency?

A cryptocurrency (crypto) is a digital currency that is available electronically. A cryptocurrency unit is called a coin, and it does not have any physical form.

Users can buy or sell a cryptocurrency using conventional fiat money (i.e., USD) through crypto exchanges, which then are then stored in a user’s crypto wallet (similar to conventional account).

Cryptocurrency payments (transactions) can be made between users’ wallets, idea being the same to what is common with fiat transfer payments between accounts. Depending on the cryptocurrency, some vendors allow payments for services or goods. It can also be used to exchange money to other cryptos or back to fiat currencies.

What is Blockchain and why is it important?

Cryptocurrencies are powered by Blockchain technology which means that all cryptocurrency transactions ever made are stored at a publicly available database (ledger).

A ledger is a decentralised database, which means that crypto network has all existing transactions history and is also responsible of new transaction validation. A crypto network is not controlled by any central authority (company, government). It consists of a number of independent machines (nodes) across the globe that hold ledger copies and can execute new transaction validation tasks. Any user can join a cryptocurrency network by adding a node – a machine (PC or laptop with special cryptocurrency software installed) that becomes a part of the network that holds a copy of all existing transactions and validates new ones.

Major cryptocurrencies having numerous participants have virtually no chances for anyone to tamper ledger transactions. Any invalid/counterfeited transaction amending transaction history would not match other nodes’ history and will be rejected. For false transaction to be considered valid, the majority of the network (51%) should be tampered as well. Note that historic transactions are irreversible (immutable), so if a transaction is made and confirmed by network majority – it is set in stone and can never be undone. Compensating transactions might be added, but existing ones will never be deleted.

How is a cryptocurrency created?

How do new cryptocurrencies appear?

Cryptocurrencies are powered by Blockchain technology and new cryptocurrencies can be freely created by anyone. Bitcoin is the most adopted cryptocurrency at the moment, but similar principles apply to absolute majority of all 10K+ cryptos available.

The integral parts of a cryptocurrency are:

- Blockchain platform. It is possible to create a new cryptocurrency either as coins or tokens. Generally, coins require more technical work while tokens utilise any existing Blockchain solutions.

- Consensus mechanism: a protocol to ensure protection against faulty transactions and valid transactions distribution

- Cryptocurrency parameters: block size, mining rewards, transaction limits, etc.

How are new coins created for existing cryptocurrencies?

Once a cryptocurrency is created, it will have an embedded algorithm on how new coins are created. This algorithm is an open source, so a number of coins in the market will be known and fully predictable to create in the future. I.e., Bitcoin has ~19 million coins available in the circulation now and it can have a maximum of 21 million coins, so no more than 2 million bitcoins will ever be created (mined).

The actual creation of new coins is done by a “mining” process executed by Blockchain nodes. As stated earlier, anyone can join mining on Blockchain network by adding a node – installing cryptocurrency software on their machine. The machine then dedicates resources (computing power) to solve math queries needed to create new coins or to validate new transactions.

Depending on cryptocurrency mining algorithm and cryptocurrency maturity, creating a coin might require tremendous number of resources and individual miners can no longer compete with pooled mining. I.e., it is widely known there are dedicated device farms powered by power plants as Bitcoin’s Blockchain nodes for Bitcoin mining.

Crypto staking

There are some technical differences in mining coins based on consensus mechanism of blockchain. It is worth mentioning that currencies based on Proof-Of-Stake (i.e.: Ethereum, Algorand, etc.), allow owners to earn crypto coins if they stake (put aside) number of coins for a certain amount of time. This can be compared to earning an interest rate from a fiat currency in the conventional financial world.

Cryptocurrency features

Key attributes for cryptocurrencies:

- secure: crypto transfers are confirmed with user’s private key (unique secret key owned exclusively by user)

- decentralised: it is not owned by a central authority (any company or government) and has a transparent distributed digital ledger

- anonymous: crypto transfers do not require knowledge about the cryptocurrency holder

- immutable: transactions cannot be back changed. Once a transaction is confirmed, it will never change.

- predictable supply: mining new coins is based on an open-source transparent algorithm that defines the rate at which new coins are introduced as well as maximum coins allowed

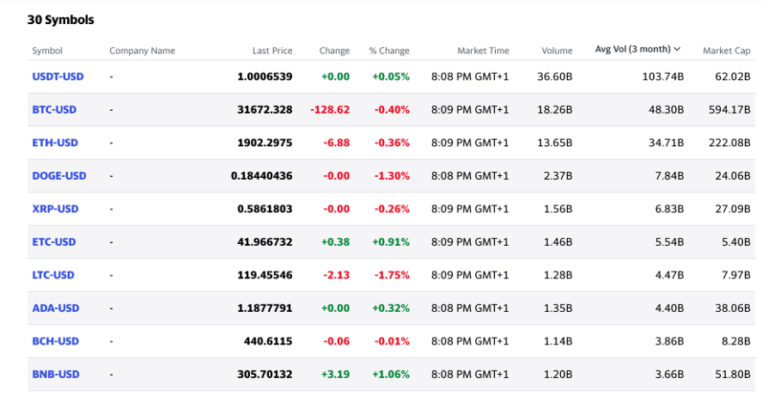

What are the most popular cryptocurrencies?

There is a wide range of cryptocurrencies currently available, and it is a volatile market. To get the idea of the most recent cryptocurrency popularity, you can have a look at Yahoo! Finance and sort it by crypto trading volume:

There are numerous coin screening tools and techniques that we will leave outside of this blog.

What is a crypto wallet?

Basically, a crypto wallet can be considered as an account where you store the coins you own.

Technically, and to be more precise, it is your private keys (secure character string combination) that matter.

Ownership of coins live as transaction records on ledger, so a crypto wallet will have your private keys to make further transactions of the assets that you own. These keys can be stored in multiple ways:

- software wallets (crypto wallet apps, web/desktop wallets)

- hardware wallets (paper wallets, printed QR codes, keys stored in USB, etc.)

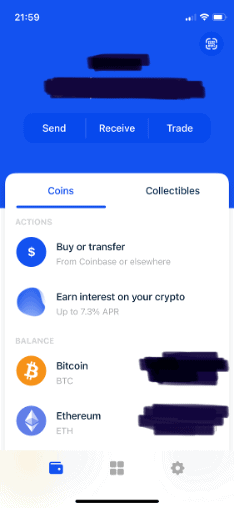

Examples of crypto wallets apps can be: Coinbase, Atomic Wallet, i.e.:

There are numerous crypto coin screening tools and techniques that we will leave outside of this blog.

What is a crypto exchange?

Crypto exchanges act in a similar way as conventional exchanges like a stock exchange, commodity exchange, etc.

It is a digital marketplace where buyers and sellers can trade their crypto coins or exchange it to fiat currencies and back.

There are a number of crypto exchanges facilitating crypto trading: Coinbase, Binance, Kraken, etc.

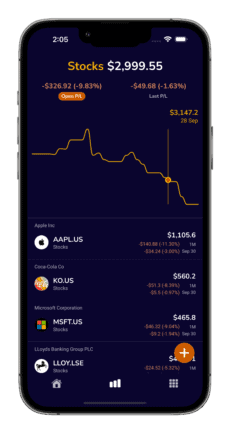

How is a cryptocurrency traded?

Generally, the process of trading cryptos will involve:

- registering to a crypto exchange

- providing bank account details (for fiat deposits as well as legal purposes)

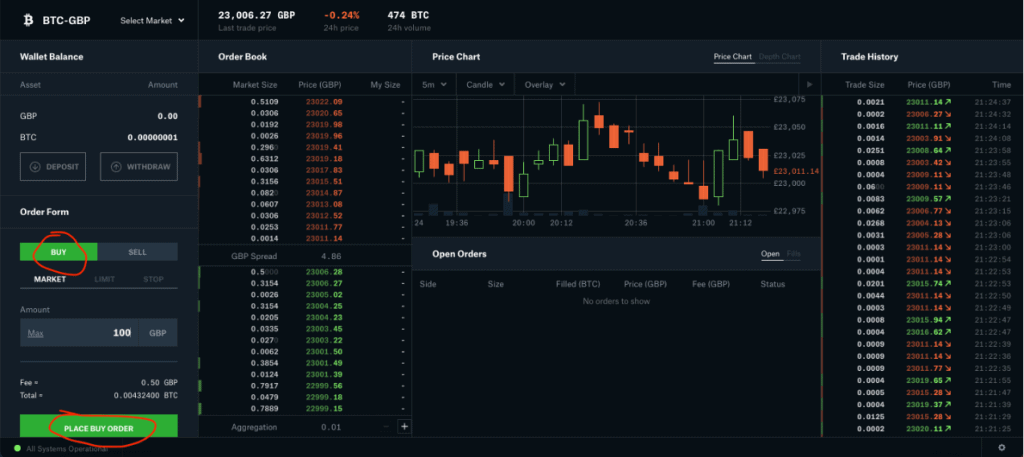

- putting a trade transaction request using a crypto exchange’s interface, i.e.:

Given the decentralised nature of cryptocurrencies, there is pressure from multiple governments and financial institutions to limit crypto exposure to the public. This might directly affect your access to crypto exchanges depending on your residency.

Crypto exchange vs Crypto wallet

Sometimes companies would provide both crypto wallet and crypto exchange services which might be confusing. I.e., Coinbase provides both, so you could buy Bitcoin via their exchange and access it in their Coinbase wallet. However, your buy/sell provider (exchange) does not have to be the same as your storage provider (wallet).

You can buy different multiple cryptocurrencies via different exchanges but store them in one single wallet. To transfer coins from your crypto exchange account to your wallet you will need to create a transfer transaction, confirm it with your private keys and might pay some transaction fee as well.

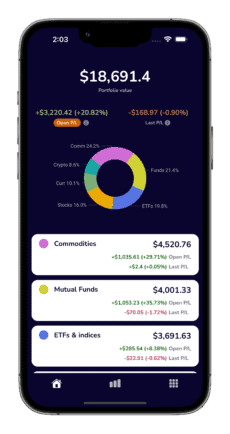

What is a crypto portfolio and how to track it?

A crypto portfolio is an umbrella term for all the cryptocurrencies that you own.

A crypto portfolio might be a part of your wider investment portfolio containing a number of different assets like stocks, ETFs, mutual funds, etc.

Historically, crypto prices have been volatile which means that having right portfolio tracking tools is paramount to monitor your crypto investment strategy.

Because of crypto volatility, prices might be significantly different across exchanges, hence the majority of crypto portfolio trackers provide a ‘global average’ price. This price is based on the average prices of a particular crypto present across all known exchanges.

You can find more details on crypto portfolio tracking on our portfolio trackers comparison summary.

SUMMARY

We demystified some of the key cryptocurrency concepts and went through how cryptos are created, traded, and tracked.

If you found it useful or wish for us to add anything – leave a note below and we will try to accommodate that!