Avoid mistakes when selecting an investment

Both new and experienced investors go through the process of reflecting risks when buying a new investment. This is to minimize if not eliminate making mistakes on buying any assets that will negatively impact not only their finances but also their personal well-being due to the potential consequences of having significant investment losses.

The usual goal with investing is a successful, steady growth of one’s financial wealth. So, making an investment mistake is not something investors take lightly. However, committing mistakes is impossibly inevitable. They are very common. Learning from them is crucial but repeating the same mistakes should be avoidable. Here are some of the most common mistakes that you certainly need to recognise in your investment strategy.

Unknown investment goal or vision

People venture into investments with the objective of fulfilling their vision, be it funding for their retirement, a home, to support their business endeavour and many other reasons. Once you have outlined what you want to achieve with your investment, stick to the core principles that will help you achieve them. These include understanding how much you want to invest, how much returns do you need to achieve, how long would you like to hold on to your investments, your risk tolerance, and the amount of effort and time you can maintain them.

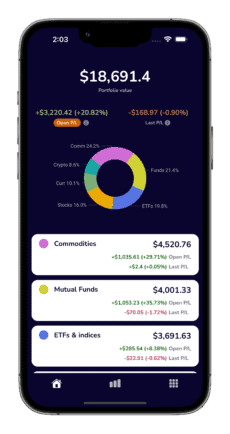

Lack of portfolio diversity

Diversifying your portfolio is a good strategy to mitigate risks that you might potentially face. It minimizes the overall volatility of your investments over the long-term because not all assets will perform in the same way at the same time. To diversify your portfolio, you can create a combination of investments such as stocks, cryptocurrencies, ETFs and Indices, mutual funds, and commodities. You can read our blog about the different investment types here.

Having a diversified portfolio can potentially maintain or enhance your profits despite various economic shake-ups because assets can respond or perform differently to a similar circumstance. They have different levels of performance and risks, so it balances loses and gains and provide greater returns in the long-term.

If you put all your money and trust into just one investment or company, it would be very hard to recover once the investment fail. There will be almost no funds left to recover and it would take time to start building your portfolio again because you will need to accumulate wealth from another means first for you to save aside funds for new investments again.

Contain your exposure into a single investment within 5% to 10% (even 10% is risky) to start your position in a good standing. And make sure that you allocate your funds into a mixture of small segments like stocks, ETFS or mutual funds in order to distribute the risk into minimal percentages.

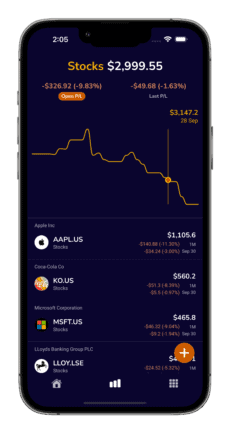

Timing the market

Day to day trading is most often compared into gambling and is risky. Often quoted from R. Johnson is the phrase “the key to building wealth is to consistently invest money, not to try and time the markets” that has been a constant reminder not to fall prey into the “get rich quick” temptation. There isn’t any asset that will perform the same way as it was the day, the month, or the year before. Looking at the trend historical trend can be a helpful solution to see how an asset is performing and therefore decide whether buying them will help your portfolio growth.

It doesn’t mean however that you should rule-out this strategy. Some investors, with the appropriate amount of experience, time and effort spent, can get quick profits successfully but this could be very difficult to maintain or repeat. Timing the market instead can be useful for you to track how variable some of the assets you are monitoring should you be keen in buying them for either short or the long-term.

Buying based on popularity

Don’t get distracted and jump the bandwagon because of an asset that suddenly became popular and skyrocketed. Make sure why you need to buy a particular investment based on your objectives and vision and not because they are the hype of the moment. Remember that an asset can crash as quickly as it soared. Look into sufficient documentation or financial backing that support their performance instead. It can be helpful to research and analyse why a particular stock or investment is behaving the way they are now. Review their company profile, historical values or performance and read news about experts’ opinion and future projections – this is a better strategy rather than basing your decision on their day-to-day hype.

Believing in future based forecast

Optimism is a good trait of becoming an investor, however, too much optimism or belief in one sector or company can be counterproductive and could potentially waste a current, better investment opportunity. Short-term trends do not always translate into long-term performance forecast, and economic events that affect assets are very unpredictable.

It does not mean that it is bad practice to invest on a potential future trend. If you believe and align your values, for example, into how green energy projects could improve our world in the future, then it would be good to investigate how governments, economies, markets and experts are reacting to green energy projects to solidify your basis that they will be successful and therefore worth investing into. There might also be promising companies that can show recent, steady success but might take decades to grow, so it is important to spread your confidence and funds into other asset segments and go back to your vision in terms of your investment timeline.

Not having a buffer money

Investors understand that taking risks is a part of the process of building or growing investments. Having a buffer money can be helpful if you want to buy a risky investment. This way, you could condition your mind that the buffer money can either grow or evaporate. This buffer money should not take away a major portion of your portfolio and should not negatively impact your financial standing.

To create a buffer fund, you can put aside a savings pot that will serve the purpose of buying a potential investment that you are still not sure would perform well despite having the pre-work of researching about it. This way, you can experiment, learn and even successfully make a significant gain without jeopardizing the overall value of your portfolio.

Relying on your gut feeling

Some investors wake up one day with a gut-feeling of luck that tells them buying an investment at a particular day or time is in the stars for them. However, this is highly susceptible to failure and despite the strategy being a clear risk, some investors fall prey to their own instincts.

It is important to remember why you want to invest in a particular investment. When you are tempted to buy an investment based on your gut feeling that they will perform well, ask yourself the following questions: what is my goal in buying this investment? What financial backing do they have? How did they perform historically? These questions can help you pause, go back to your investment goal, and think through logically the reason why you want to buy a particular asset, and most importantly, avoid buying based on excitement about an investment’s day or current performance.

Ineffective portfolio tracking

One of our blogs discusses the importance of tracking investments and how portfolio tracker apps, either in a desktop or mobile format, play a significant role in monitoring and evaluating the success of your investments. Tracking and monitoring your investments are responsible financial practices and major strategies to avoid mistakes when managing or selecting new assets to buy.

Portfolio tracker apps primarily helps in overall recognition of your financial standing, and an effective portfolio tracker app should effectively show where your assets are distributed and where you could possibly want to further allocate and diversify. Secondly, portfolio tracker apps show investment performance and comparisons throughout time which is crucial if you want to avoid flaky and underperforming assets. Portfolio trackers apps can show which companies or investments have performed well throughout time with significant data and documentation to support their performance.

Here is a blog about the best portfolio tracker apps available in the market and their comparisons.

Summary

Mistakes are a common occurrence in investment, but this should not hinder your goal or vision of diversifying and growing your wealth. In the process, mistakes and should help you learn and recognise what you need to avoid in order to avoid committing them again. This is especially important for beginner investors as this helps shape their investing experience towards success.

Once you have selected which investments are parallel to your vision, tracking, monitoring and evaluating them is a major strategy to maintain good portfolio performance. It is important to select the right portfolio tracker app that serves the purpose of effectively presenting current and historical performance, comparisons and documentation which in the process help you recognise and avoid underperforming or too good to be true investments in your investment journey.