Investment simulator for historical portfolio performance

Why an investment simulator might be useful to you?

Using an investment simulator can be beneficial regardless of whether you are a starting or a more experienced investor.

Beginner investors: armor yourself with knowledge

If you are a starting investor, using an investment simulator might be a good first step towards an investment journey. Investment simulation includes using a virtual portfolio, or ‘paper trading’ as it uses virtual money. It provides an opportunity to familiarize yourself with various investment types and key trading concepts without risking your real money.

A general mantra for virtual trading is that it’s a safe, risk-free environment to build up your skills. Note that virtual trading results might not necessarily be considered as an indication of future real-life trading results. One – it is much easier to risk virtual than real money and two – market conditions and investment valuations are constantly shifting. For beginner investors, the key benefit of virtual trading is educational.

Experienced investors: test your investment strategy with historical data

For a more experienced individual investor, investment simulators bring an opportunity to test your investment strategy using historical market data. Obviously, historical performance does not necessarily indicate future results, but it’s a very powerful tool to test your portfolio diversification, resistance across financial crisis, long term growth, etc. There are a number of investment simulators that have different goals for different user groups. Let’s review them in the next section.

What are the types of investment simulators?

There are three main groups of virtual portfolios:

- Demo trading accounts

- Educational virtual portfolios

- Portfolio trackers for historic performance simulation

Demo trading accounts by trading platforms

All these investment simulators will be geared towards using actual trading platforms with your real funds. And real commission 😂

Generally, you will have a starting budget, and you have an opportunity to trade stocks in real time (or with slight delays). You will be able to trade the same way as you would using the real account, so same restrictions will apply (i.e.: market open hours, investments selection, search/screening tools). That mainly allows you to familiarize yourself with the platform. If you consistently simulate trades by using the platform, you could also verify your investment strategy to some extent. However, note that you won’t be able to backtest your strategy by setting up trades in the past and immediately getting performance results as of up to today.

Trading platform examples that allow demo accounts include: “eToro”,” Plus500”, “IG”, “Ameritrade”, etc.

Educational virtual portfolios

This is mostly suitable for beginner investors. Virtual portfolio providers will offer some learning materials and courses (i.e.: investment types, fundamental or technical analysis indicators) along with the investment simulator usage. Some might also wrap virtual investing as a game with competitions, performance rankings, achievement badges, etc. Usually, it won’t offer the full-blown trading platform features with all the whistles and bells, but it will be good enough to grasp key concepts to build your foundation knowledge about trading.

Education virtual portfolio examples include: “Investopedia Stock Simulator”, “Wall Street Survivor”, etc.

Portfolio trackers for historic performance simulation

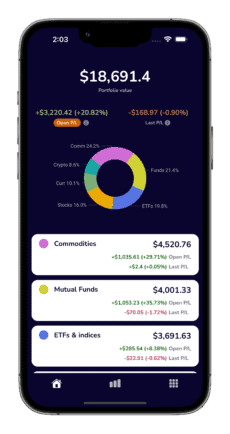

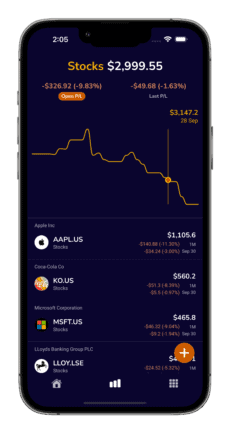

Portfolio trackers can also be used as investment simulators. This is mostly suitable for more experienced investors who wish to have a quick way to back test their trading strategy. The process include:

- Defining your test portfolio with various investment types (stocks, funds, commodities, cryptos, etc.)

- Using a portfolio tracker to enter virtual trades for selected investments in the past

- Portfolio tracker re-calculating your portfolio with up-to-date current value, gain/loss reports, etc.

Using portfolio trackers as investment simulators might be especially useful if you have a wide range of investment types, different currencies, or different regions. Decent portfolio trackers will allow you to simulate performances of vast number of investments going back as far as 20+ years.

If you wish to try this approach, have a look at our shortlisted portfolio trackers ([/blog/best-all-in-one-portfolio-trackers/#summary] based on device type and features.

SUMMARY

If you are a beginner investor seeking to start investing, either an educational virtual portfolio or a virtual account on one of the trading platforms will do.

If you are looking for an investment simulator to back test your portfolio’s historical performance, try one of the portfolio tracker apps and start by entering backdated trades.