Helpful Resources to Help You Start Investing

Educating yourself about investing is the first step towards investment success. There are abundant resources that can help you start an investment as a beginner. You don’t need to finish a degree in economics or finance in order to understand and begin investing. But it is crucial that you know where to look at and get updated about financial market news whether it is offline or from online such from newsletters or social media feed.

As a starting investor, it is important not to rush to decide and you should spend an appropriate amount of time learning about selecting an investment. The first step is to know how to pick reliable sources about different investment types that reflect your investment vision or goal. However, the learning process shouldn’t take over your entire day to day activities, so try answering these questions to get ideas on picking the right resource materials for investing.

- What media are you comfortable with? Do you like to learn from investment guidebooks? Online courses?

- How much time do you want to invest in learning? What would your learning schedule look like for weekdays or weekends?

- How would you like to get updates from the stock market? TV? Mobile app? Websites?

Once you have found dependable high-quality resources, it is important not to lose too much time being on the loop. In this case, it will be easier subscribing digitally through mobile or desktop apps or e-newsletters which could give you instant notifications. Here are some of the most common resources online that you can try.

Investing resources

- Coursera – has free online courses that covers topics including fundamentals of investing, trading guides, investment portfolio management, finance for non-professionals, and hundreds of invested related courses that you can accomplish in a few hours.

- Morning Star Classroom – have self-study courses in relation to specific asset types such as stocks, funds, bonds, ETFs and building and managing portfolio. It is paid membership but as a beginner you can sign-up and get 14 days free access.

- Investopedia’s Investing 101 Tutorial – provides fundamental lessons on investing, trading and portfolio and risk management

- Investors Underground – offers professional guidance and tips regarding day trading. They offer free courses which you can initially try and if interested, you can subscribe to get membership for more access to education resources and their trading community.

- Udemy – is a provider of an online platform for both students and instructors to learn and teach courses about finance and business. They feature most popular topics from online investing from beginners up to investment analysis and portfolio management.

There are also reliable sources of current finance market data that you can start reading about in order to grasp how market assets behave or how they are affected by news and current events locally or globally.

- Wall Street Journal – has extensive coverage of up-to-date news and headlines in relation to business, economics and finance industry.

- Bloomberg – provides news about business, stock market data and analysis. It also provides financial data services and analytics.

- Yahoo Finance App and Website – has financial data including stocks market update and offer tools for personal finance management.

- Reuters – it is one of the biggest news providers of prompt business news and financial market data, mainly stock exchange information and analysis.

- MarketWatch – is a website that offers current stock market information including finance and business news, analysis and commentary, similar with the Wall Street Journal.

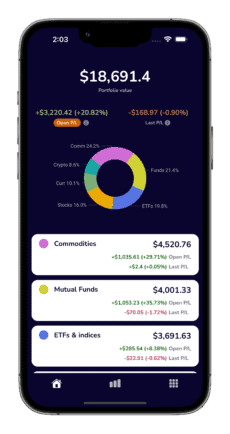

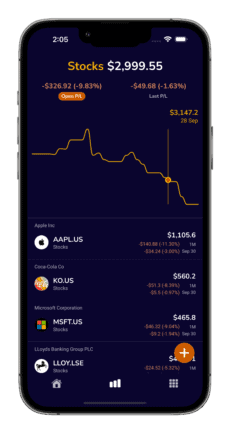

Once you have established what investment type and assets you want to invest in with, there are apps that can help you track and monitor them. Read our blog about the best all-in-one portfolio trackers which covers apps that provide both news and stock market data that you can follow.

Are investment courses and subscriptions worth it?

You don’t necessarily need a personal advisor to learn about investment. But with the abundance of self-learning resources online, it is up to your enthusiasm and motivation to embark on ways towards beginning investment. Devoting a few hours per day or weekend to start learning about the right investment pathway with digital resources would benefit you in the long term. Just remember that learning does not stop when you have bought your first few assets because investment itself is a continuous learning experience and as you move along so should your learning materials and tools.

You can find free courses online which cover basic and foundation knowledge about investing. And these can be useful not only in building your understanding about can also let you get a feel of the different learning courses and stock market watchlist platforms. Advanced courses and personal financial guidance and advise would need paid subscription and their expense depend on what outcome you want to achieve. These could prove beneficial in providing you richer analysis of the financial market and provide gains for you in the long-term depending on how you incorporate them into your investing strategy.

In summary, there are thousands of online resources that you can find online, but it is crucial that you find quality, reliable materials which resonates not only with your investment goals and objectives, but also those which fit your learning style and are efficient in providing financial news and information.